When choosing equipment financing that works best for your business, traditional financing and leasing don’t always make the cut. A one-size-fits-all solution doesn’t work for every business.

So where do you turn for a custom financing solution?

Flexible Financing Means Custom Plans for Your Needs

Flexible financing is custom equipment financing that matches to your business needs. With flexible financing, your business can make financing more affordable based on your situation and matches the ups and downs of your business. Watch how our flexible lending criteria increased Icon Screening, Inc.'s job output.

This article explains six common flexible financing plans offered by top-of-class equipment financing lenders . These six plans are by no means set in stone – they are the starting points for building your own custom plan that fits your needs.

Want to learn how we build these plans? Talk with a Financing Consultant today.

In this article…

- Six Common Flexible Financing Plans

- 100% Financing

- Step Payments

- Equipment Upgrade Program

- Wrap Financing

- Seasonal Payment Program

- Skip Payments

- Build Your Flexible Financing Plan in a FREE Consultation

Six Common Flexible Financing Plans

When your business needs equipment, you have options on how to finance it. You have a list of available flexible financing plans.

100% Financing

Looking to keep cash in your hands? Get financing with no down payment and use your cash for operating expenses and investing in crucial areas of your business.

|

Buy Now, Pay Later

Need time to generate revenue? This plan offers deferred payments for 90 to 180 days so you can start using your equipment before your first payment is due.

|

Skip or Step Payments

Are you tired of the typical payment structure by other lenders? This plan allows you to get creative with a flexible payment structure that allows you to pay less upfront or more depending on your cash flow.

|

Seasonal Payment Program

Have an inconsistent revenue stream? Get a creative payment plan that matches the timing of your sales.

|

Equipment Upgrade Program

Want to replace your old equipment? Grow your business by upgrading to new equipment while maintaining a consistent monthly payment.

|

Wrap Financing

Looking to acquire multiple equipment units at once? Save money on your monthly budget while keeping it simple with one monthly payment.

|

See a perfect plan for your business? Get started by applying now for your very own flexible equipment financing plan.

Let’s look at the benefits of each plan.

100% Financing

Just like in the name, this plan does exactly what it sounds like.

100% Financing is a plan where you provide the lender no initial cash payment for the equipment you want to finance. This means you can conserve your cash and reap the rewards of your equipment immediately.

Ditch the down payment and receive your equipment for no money down. Use the revenue generated from your equipment for your needs.

Apply now to start building your own 100% Financing plan.

Step Payments

How do you want to control your financing? It can all be up to you.

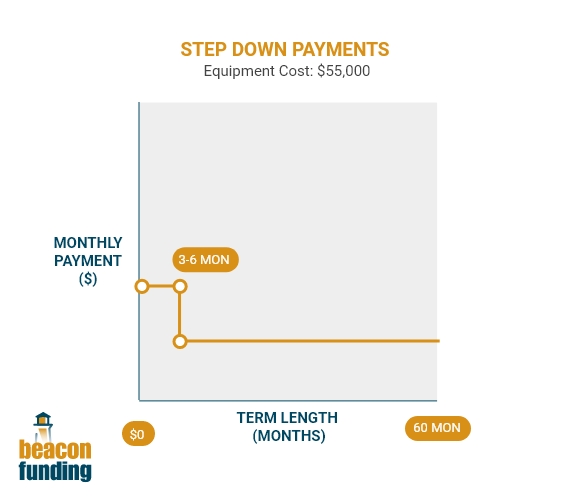

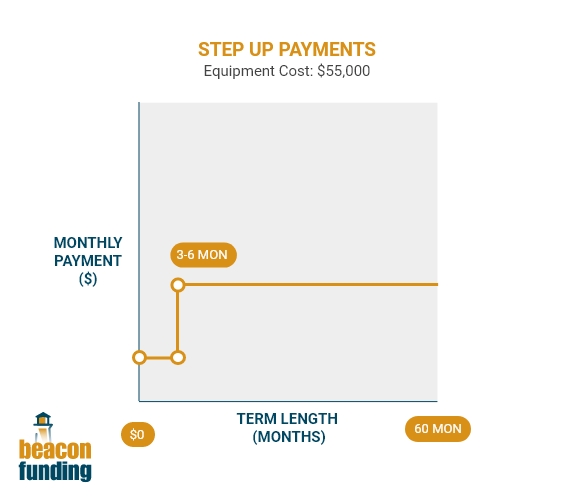

Step Payments allow you to control how you manage your initial 3 to 6 monthly payments. Depending on what you need, you have options to start your equipment financing with either higher or lower monthly payments.

You can use that time to ramp up your business, train employees, save more cash, and build your customer base.

Step Down Payment

|

Step Up Payment Plan

|

- Knock out your largest payments first.

|

- Give your equipment time to generate revenue.

|

- Great for businesses who want to make future payments easier.

|

- Great for young businesses strapped for cash.

|

- When you choose to pay more upfront in the first 3 - 6 months, your payments decrease month-to-month.

|

- When you choose to pay less upfront in the first 3 - 6 months, your payments increase month-to-month.

|

|

|

Apply now to start building your own step payment plan.

Equipment Upgrade Program

Do you already have a lease but afraid of the long-term lock-in of upgrading your current equipment? No worries – easily replace your old equipment before your existing financing term is over.

An Equipment Upgrade Program allows you to trade-in your equipment before your existing financing term is over and get an asset of equal or greater value. That means you can grow your business with a quick upgrade while maintaining a consistent monthly payment.

Upgrade to Bigger, Better Equipment

- Upgrade with no additional financing charges to equipment of equal or greater value.

- Get the latest equipment model while mitigating risk.

- Gradually grow your company at the pace you set.

Meet Higher Demands

- Say yes to larger contracts.

- Add bigger equipment.

- React to market changes quickly.

Keep Your Business Growth Consistent

- Grow your business, not your debt.

- Upgrade without taking on two monthly payments.

- Trade-in equipment before your existing financing term is over.

Apply now to start building your own Equipment Upgrade plan.

Wrap Financing

Looking to acquire multiple equipment pieces at once? We make it easy.

Wrap Financing allows you to keep it simple by “wrapping” multiple equipment units together under one lease. It’s a great way to save a little bit of money on your monthly budget while keeping your financing simple with one monthly payment.

- Perfect for adding more equipment.

- Lower your existing monthly payments.

- Grow your business faster.

The best part? Your bundled lease doesn’t even need to start with Beacon Funding – we can wrap a lease you already have from another lender!

Apply now to start building your own Wrap Financing plan.

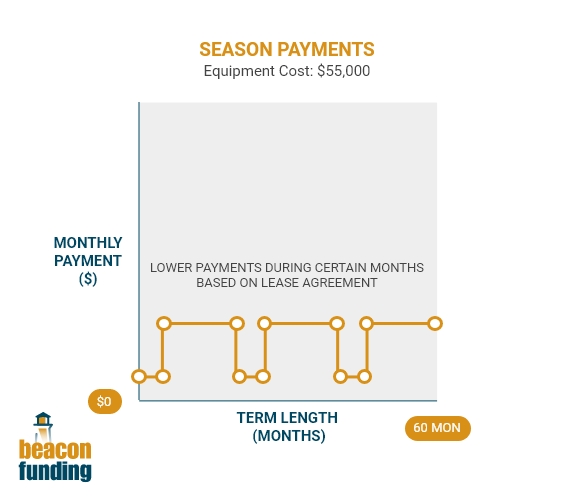

Seasonal Payment Program

Just like it sounds, this flexible plan allows you to structure a payment plan during months that are more in-line with months of your lighter revenue.

A Seasonal Payment Program allows you to match your monthly payment with the changing seasonal demand for your product. You can enjoy lower monthly payment for 2 months agreed upon in your lease agreement.

If you have an infrequent income stream, you can enjoy lower payments for two months to offset the months of your lower income.

Apply now to start building your own Seasonal Payment plan.

Skip Payments

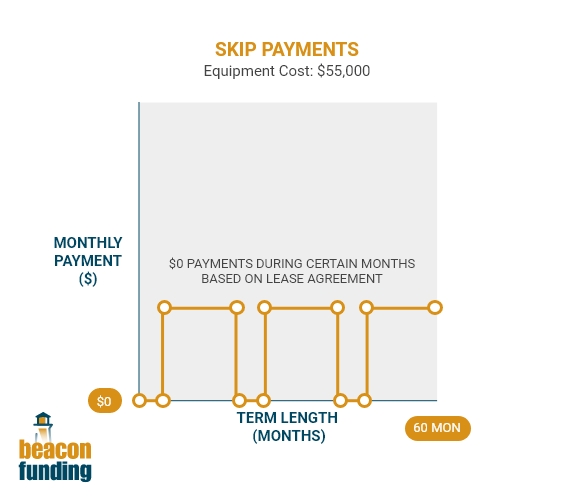

Plan when you want to skip a payment for your needs.

A Skip Payment refers to certain months in your stream of payments where you do not owe a payment. Your business gets to “skip” a month or two depending on your pre-negotiated contract. This can apply to a business that might have some seasonality in high volume versus low volume months.

Skip Payment

- Choose to skip payments during months agreed upon in your lease terms.

- Offset your more profitable months by preferring a lower monthly payment or none at all.

Traditional Financing

- Payments are equally distributed throughtout the year.

- Pay the same total annual payment over the course of the year.

Apply now to start building your own Skip Payment plan.

Build Your Flexible Financing Plan in a FREE Consultation

Your business is unique, your financing should be too. Who doesn’t want financing that matches the ups and downs of their business? It all starts with a discussion about your financing goals.

Create your custom financing plan by talking with a Financing Consultant.

Book a FREE consultation today and explore options based on your needs. For faster results, be sure to mention in the booking tool’s comments which flexible financing plan you are interested in when you schedule your consultation.