Tow trucks are crucial in the automotive and roadside industries, serving as vital business equipment. These specialized vehicles enable swift and efficient towing of other vehicles, proving invaluable for emergency roadside assistance and vehicle transportation services.

For businesses looking to invest in a tow truck, it's essential to consider how much it costs to lease a tow truck. Tow truck prices vary based on model, size, and features, typically from $25,000 to over $150,000, so it’s also important to explore options like tow truck leasing and financing to make adding one to your fleet more affordable.

This article will explore the expenses of acquiring a tow truck and the different financing choices available to businesses.

In this article…

- Finding The Right Tow Truck for Your Business

- Achieving Milestones for Your Young Towing Enterprise

- Decrease Upfront Costs by Exploring Leasing & Financing Options for Tow Trucks

- What is Tow Truck Leasing?

- Benefits of Leasing Tow Trucks

- Factors to Consider When Leasing or Financing a Tow Truck

- Lease or Finance Your Next Tow Truck with Beacon Funding

Finding The Right Tow Truck for Your Business

A tow truck serves the function of towing or transporting other vehicles. In emergencies, it provides roadside assistance by towing away malfunctioning vehicles. Furthermore, businesses in automotive services, such as scrap yards, auto repair shops, or repossession agencies, frequently employ tow trucks.

Tow trucks are available in diverse sizes and designs tailored to meet various requirements. This versatility allows them to efficiently address various towing needs in different situations.

Light-duty tow trucks, being smaller and less powerful, are ideal for towing cars and small pickups.

On the other hand, heavy-duty tow trucks, being larger and more powerful, can handle more substantial loads, including towing large commercial vehicles.

Achieving Milestones for Your Young Towing Enterprise

Acquiring a new tow truck marks a significant milestone. If you have the funds ready, what upfront costs should you be prepared for?

Cost Range for New Rollback Tow Truck

Depending on the brand and model, a new rollback tow truck can range from $90,000 to $150,000. Newer models, although pricier, often come with advanced features and enhanced performance compared to their older counterparts.

Pricing Variations for New Wheel-Lift

Whether you need a truck with a boom, wheel lift, forks, or light bars, prices can vary, ranging from $90,000 to $150,000. The specific features and capabilities of the truck influence the overall cost.

Investment for a New Heavy Wrecker

For those requiring the capacity to haul extremely large vehicles, a heavy wrecker can be a substantial investment, reaching as high as $1,200,000. For most businesses, keeping more cash within the business is a crucial consideration when making such significant purchases.

Decrease Upfront Costs by Exploring Leasing & Financing Options for Tow Trucks

Many towing companies opt to finance their tow truck acquisition rather than make an upfront cash payment. This approach enables them to distribute the cost over time, making manageable monthly payments.

Equipment Financing

Specifically designed for acquiring equipment, including tow trucks, this financing type uses the truck as collateral. This reduces the lender's risk, possibly leading to more favorable terms for you. It's a way to help you secure funds to acquire a tow truck for a low monthly payment.

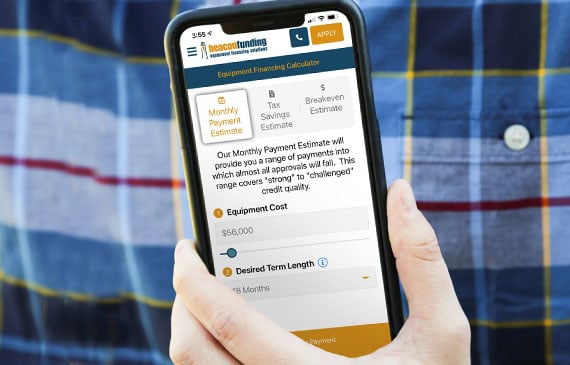

CALCULATE YOUR LOW MONTHLY PAYMENT

How Financing Benefits Your Towing Company

Financing allows you to add a revenue-producing tow truck into your business for a low monthly payment. By conserving your cash, you can invest it in other areas of your business where it can be put to work and generate additional profit.

Or, if you prefer to keep the cash on hand, you can use your liquidity for other things like truck repairs or payroll.

Not only can you conserve your cash, you’ll also be able to:

Lease-to-Own Financing

If you're unsure whether to lease or buy outright, lease-to-own financing offers a middle ground. You can initially lease the tow truck and then decide to purchase it at the end of the lease term. This purchase option provides flexibility while allowing you to eventually own the tow truck.

What Is Tow Truck Leasing?

Tow truck leasing is an agreement where you can add a tow truck into your business for a specific period of time for manageable lease payments.

Additionally, leasing offers different options at the end of the lease term. While the most common purchase option for tow truck leasing is 10%, you can usually pick anywhere from $1 option up to FMV depending on what your situation and goals are.

Benefits of Leasing Tow Trucks

Choosing a lease-to-own option is a smart move for towers aiming to keep their cash or line of credit available for other expenses or investments. Opting for a used truck through leasing is a healthy option for your business.

The leasing decision brings various advantages, such as:

Diverse Payment Options

The benefits of leasing tow trucks offer flexibility with payment structures, such as skipped payments during months agreed upon in your lease terms or a low monthly payment for the initial six months in a step-up payment plan. This gives your business time to generate profits with the tow truck before regular payments kick in, providing a financial buffer.

Write Off Lease Payments

Leasing a tow truck has a tax advantage for the lessee. Since the lessor maintains ownership of the tow truck, the lessee benefits by using the tow truck as if they owned it but gets to account it as an off-the-books expense and write off all the monthly payments vs depreciating it.

Be sure to consult a tax professional before leasing a tow truck

Remember: Be sure to consult your CPA or tax advisor to discuss how much you can save with a write-off for your lease payments.

Key Considerations for Used Tow Truck Leasing

To maximize the benefits of leasing used tow trucks, here are crucial tips to consider:

- Understand the towing capacity, especially if you'll use the truck for different classes of vehicles.

- If you’re buying used, prioritize a pre-purchase inspection by a professional mechanic, even if the tow truck has a high-reliability rating. This step is essential to identify signs of wear and past usage.

- The length of the lease or finance term should not be longer than the average time before the truck will need major repairs. Be sure to do your research before buying one, as a problematic truck may end up costing you more in the long run.

Factors to Consider When Leasing or Financing a Tow Truck

To make wise investments and guarantee the success of your business, it’s essential to comprehend your towing requirements. Take into account the following considerations:

Choosing the Right Tow Truck

When picking a tow truck, look closely at how much weight it can tow, its engine strength, and other technical details. Ensure the truck can handle different towing jobs, from light to heavy loads. Understanding these details helps the truck work well for all kinds of towing jobs you might have.

Following the Rules

Ensure the tow truck follows the rules set by your local area and state. Check if it has the right licenses, meets safety rules, and follows environmental laws. This keeps you out of trouble and makes your towing business look good and responsible in your community.

Taking Care of the Truck

Check the papers showing how well the tow truck has been handled. If the truck has been looked after properly, it’s less likely to break down when you’re towing something. Regular care and maintenance keep the truck in good shape, ensuring it works well and keeps your customers happy.

Understanding the Lease or Financing Deal

Read and understand everything in the agreement before leasing the tow truck. Consider the duration of ownership, monthly payment commitments, potential mileage restrictions, and additional fees when evaluating a purchase. Assessing these factors comprehensively ensures a clearer understanding of your acquisition's overall cost and terms. By comparing different lease options, you can find the best deal that keeps your towing business financially healthy.

Getting the Right Insurance

Make sure the tow truck has enough insurance coverage. This includes protection from accidents, damage to other people's property, and overall coverage. Having good insurance keeps your business safe from unexpected problems during towing. It's like a safety net for your business.

Choosing a Trusted Brand

Learn about the company that makes the tow truck. If they have a good reputation, it means their trucks are strong and work well. Picking a tow truck from a trusted brand reduces the chances of it breaking down suddenly. A good reputation shows the company cares about making quality trucks that last a long time.

Making it Your Own

Moreover, putting your business logo on the tow truck is strategic. It establishes a professional and cohesive brand identity and serves as a mobile advertisement for your towing services. Customizing your tow truck makes it more functional and contributes to setting your business apart in the competitive towing industry, enhancing brand visibility and recognition.

Lease or Finance Your Next Tow Truck with Beacon Funding

In conclusion, determining the cost of leasing a tow truck is a multifaceted process that requires thoroughly examining various elements. Beyond simply looking at the monetary aspect, it involves scrutinizing lease terms, identifying potential additional costs, and ensuring compliance with regulations. The significance of maintaining the tow truck in optimal condition cannot be overstated; it directly influences its reliability and performance during towing operations.

Additional critical considerations include selecting a reputable brand and customizing the tow truck to meet specific operational needs.

It goes beyond a financial transaction – leasing a tow truck is making a strategic investment in the longevity and success of your towing business. By meticulously considering all these aspects, you can secure a lease that not only aligns with your immediate financial capabilities but also positions your business for sustained success in the long run.

GET STARTED WITH LEASE-TO-OWN

While this is a lot to take in and can seem complicated or overwhelming, we are here to help. We make the process simple and easy by matching your needs to a leasing plan that works for you and your business.