In the dynamic landscape of 2024, acquiring essential equipment for your business is a crucial step towards growth and success.

Whether you’re a small start-up or an established enterprise, having the right tools can significantly impact your operations.

However, the cost of equipment can often be a financial hurdle. This is where equipment financing comes into play, offering businesses the opportunity to obtain necessary assets without straining their cash flow. By opting for equipment financing, businesses can spread the cost of acquiring machinery, tools, or technology over time, making it more manageable.

In this article, we'll break down the process of securing equipment financing into 6 simple steps, ensuring that you easily navigate the complexities. From assessing your equipment needs to understanding the types of financing available, we'll walk you through each stage.

In this article…

- What is Equipment Financing?

- How Does Equipment Financing Work?

- Types of Equipment Financing

- Can a Start-up Get Equipment Financing?

- The Process of Start-up Equipment Financing

- Start Financing Today

Financing equipment is not just about securing funds – it’s about making well-informed decisions that align with your business goals. So, let's embark on this journey together, exploring the avenues that will empower your business to thrive in the competitive landscape 2024.

Whether you're looking to upgrade technology, enhance your production capabilities, or learn how to get equipment financing, this article is tailored to make equipment financing accessible and straightforward.

What is Equipment Financing?

Equipment financing is the process of acquiring equipment using a loan to purchase machinery. When your growing business need equipment, but don’t have enough cash, lenders who specialize in equipment financing provide an affordable and flexible means with a low monthly payment.

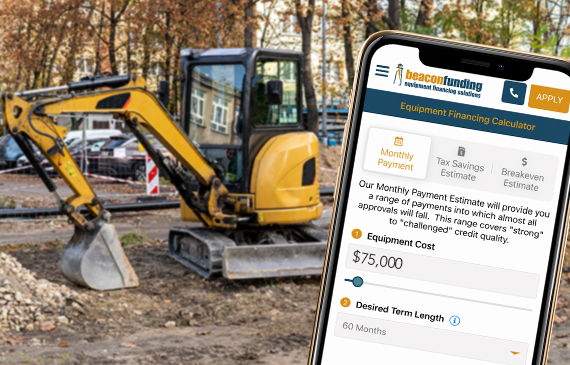

CALCULATE YOUR MONTHLY PAYMENT

Even if you have enough cash, equipment financing provides a prudent way to keep liquid funds available for unforeseen emergencies or invest into potential opportunities rather than tying them up in long-term assets.

How Does Equipment Financing Work?

Equipment financing involves obtaining a loan to acquire essential business equipment. This equipment can range from vehicles like tow trucks to stationary heavy-duty printing machines in decorated apparel.

When securing an equipment loan, you commit to making a manageable monthly payment that covers both interest and principal over a predetermined period. As a safeguard, the lender may request a lien on the equipment as collateral. Upon full repayment, you gain ownership of the equipment without any liens.

Types of Equipment Financing

Whether you’re a start-up or an established business, getting essential equipment in 2024 is often a pre-requisite for success. However, buying equipment can be a daunting financial task.

This is where equipment financing emerges as a strategic solution, allowing businesses to obtain the necessary machinery without compromising your cashflow.

Equipment Loans

Securing an equipment loan involves borrowing a lump sum to purchase needed machinery or assets directly. Businesses gain immediate equipment ownership and a manageable monthly payment.

Equipment Lease-to-Own

Opting for equipment leasing means leasing the required equipment for a specified period with the goal of achieving ownership at the term’s end.

This approach offers lower initial costs, flexibility to upgrade, and the possibility of including maintenance services. You can even lease used equipment, too.

Leasing is particularly beneficial for businesses that prefer adaptability and periodic upgrades.

Most Popular Buyout Options

|

|

- The lessee pays the lender $1 at the conclusion of the lease term.

- Ownership (or the title) is transferred from the lender to the lessee.

|

- The lessee pays the lender 10% of the original purchase price of the machine.

- Ownership (or the title) is transferred from the lender to the lessee.

|

Can a Start-up Get Equipment Financing?

Yes, start-ups can indeed secure equipment financing!

While it can be challenging compared to more established businesses, various financing options cater specifically to start-ups. Here are a few considerations:

Startup-Friendly Lenders

Lenders like Beacon Funding specialize in working with start-ups and new businesses. We understand your unique challenges and have been helping them achieve equipment ownership since 1990.

Benefits of Start-Up Financing from Beacon Funding

- Wider Credit Window: Our friendly financing experts work with you to find the strengths in your credit package.

- Flexible Payment Programs: Choose a customized option that keeps cost low while you generate revenue.

- Conserve Your Cash: Keep more savings in your hands for emergencies, payroll, and other business investments.

- Credible & Trustworthy Source: With over 30 years of experience, our BBB Accreditation & Google Reviews speak for themselves.

- Build Business Credit: Leverage your relationship with Beacon Funding to finance bigger and better equipment in the future.

- Equipment Expertise: Our unique knowledge of the equipment we finance means we understand the challenges you experience.

- High Satisfaction Rating: 96% of our customers would recommend us to a friend because of our expert service.

- Long Term Partnership: Our flexible financing and upgrade programs are designed to grow as your business grows.

Industry Experience

Having an extensive history working in your niche industry has the power to inspire trust and confidence in lenders. Clearly articulate how your experience in the industry will contribute to your young business's success.

The Process of Start-up Equipment Financing

The application process is straightforward when you're prepared to finance your equipment.

Here's a glimpse of what you can anticipate:

Initiate the Process

Contact us or complete an online form to kickstart the financing journey. Our approachable financing specialists will then connect with you to discuss your requirements and address any inquiries you may have.

Document Review and Signing

Once eligibility for financing is established, we'll provide you with loan documents for your review and signature.

Funds Disbursement

Upon receiving your signed documents, we promptly disburse the funds to enable you to procure the necessary equipment.

It's as simple as that! We've designed the equipment financing process to be uncomplicated, allowing you to concentrate on the core of your business operations.

Benefits of Equipment Financing

As a typical start-up founder, you're likely constantly seeking ways to economize and maximize your budget. An effective strategy for achieving this is opting for equipment financing rather than outright purchasing.

Equipment financing offers numerous advantages for your start-up, such as:

Preservation of Initial Capital

Opting for equipment financing allows you to conserve your start-up’s initial capital, ensuring a stronger financial foundation for operational needs and unforeseen challenges.

Maintained Cash Flow

Financing enables you to acquire essential equipment without a significant upfront payment, ensuring a steady cash flow for your start-up’s day-to-day operations and business development.

Access to Advanced Technology

Equipment financing empowers startups to access cutting-edge technology and tools, enhancing operational efficiency and competitiveness without a substantial initial investment.

Business Scalability

Startups can acquire the necessary equipment for immediate growth and scalability, aligning with evolving operational requirements and long-term business strategies.

Tax Advantages

Many equipment financing options offer potential tax advantages, such as deductions on interest payments or depreciation, providing financial benefits to the startup.

Flexibility in Repayment

Financing solutions often provide flexible repayment terms, allowing startups to structure payments based on their cash flow, business cycles, and revenue projections, promoting financial agility.

Start Financing Today

Obtaining equipment financing in 2024 requires a strategic and adaptable approach.

In a rapidly evolving business environment, equipment financing becomes a pivotal tool for efficiency and growth. With diverse options available, businesses can make informed decisions to propel themselves forward.

GET STARTED NOW