Have you discovered a promising expansion opportunity but lack the funds to pursue it? You might consider tapping into your personal credit, however there business loans that can provide a quick cash injection (with less associated risks).

Safer alternatives include working capital loans and sale-leaseback. These loans offer a swift path to access funds, allowing you to invest in your business without jeopardizing your personal financial stability.

In this article…

- Are Working Capital Loans a Good Idea in 2024?

- What Can Working Capital Loans Be Used For Today's Growing Businesses?

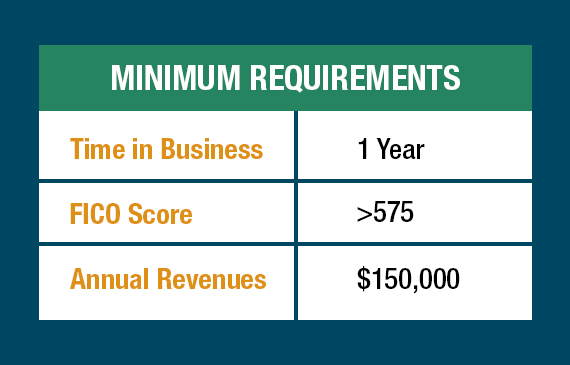

- Minimum Requirements to Get Approved at Beacon Funding

- Apply For a Working Capital Loan with Beacon Funding

- Are There Alternative Options for Cash Other Than Working Capital?

Are Working Capital Loans a Good Idea in 2024?

First, let’s look at what a working capital loan is and whether it’s right for your business.

If you require quick cash with a promising return on investment, a working capital loan can serve as a valuable resource for your business. As a business owner, you understand your cash needs can fluctuate. Your operations may need cash for launching a product, ordering needed supplies, or even unforeseen expenses. These all require prompt action to expand your cash position significantly.

But what if you come across a fantastic business opportunity that offers great profits? Imagine you’re running a business, and a big opportunity comes knocking at your door. A major client wants to work with you, but there’s a problem – you don’t have enough money upfront to kickstart the project. This is where working capital loan can be a lifesaver.

In plain terms, a working capital loan is like a quick cash boost for your business. It’s a way to get the money you need without putting up any collateral. With this cash in hand, you can do a lot of things to help your business grow. You might need to buy new materials, upgrade equipment, hire more people, or even invest in property and buildings.

Without ready cash, your business might miss out on these crucial opportunities for growth. But with a working capital loan, you can seize the moment and make the most of the chances that come your way. It’s all about giving your business the financial flexibility it needs to thrive.

Working capital loans are versatile and applicable across diverse industries, boasting a streamlined approval process and remarkably fast funding. These loans focus on speed and offer an uncomplicated renewal process.

Key Benefits of Working Capital Loans

- Businesses can address unexpected expenses with available cash.

- Access capital injections of up to $250,000.

- Enjoy a streamlined renewal process with swift funding.

- Suitable for businesses in various industries.

- Experience quick approvals and rapid funding.

- Flexible repayment plans, including daily, weekly, and monthly options.

Successful Case Study

Let’s take a look at a scenario where a business utilized a working capital loan.

What Can Working Capital Loans Be Used For Today's Growing Businesses?

Launch a new project

Embarking on a new project this year? Ensuring you have sufficient capital is paramount. Whether you’re gearing up to launch a new business location or seeking funds to optimize equipment for swift profitability, working capital loans could be your ideal financial companion.

Purchase materials

Having swift access to funds is a game-changer. Being able to complete a profitable contract often hinges on your ability to first procure essential materials. Working capital makes it easy to secure raw materials for production, restock inventory, or obtain supplies critical to your operations.

With a well-managed loan, you can ensure that your business remains agile and ready to capitalize on opportunities as they arise.

Clean Accounts Payable

Timely payment of invoices and bills fosters trust with suppliers and ensures your business’s financial health. However, there may be instances when cash flow fluctuations or unexpected expenses disrupt your ability to meet payment deadlines. This is where working capital loans step in as a strategic solution.

By securing a working capital loan, you gain the financial leverage needed to settle outstanding accounts payable promptly.

The benefits are two-fold: You uphold strong vendor relationships, potentially negotiating better terms in the future while also keeping your creditworthiness intact.

Pay Sudden Costs

Unforeseen expenses can arise without a warning. Whether it’s unexpected repairs, compliance fines, or unforeseen opportunities that require immediate capital infusion, being prepared for sudden costs is essential.

Working capital loans are your reliable safety net in such scenarios. They provide quick and flexible access to funds, ensuring you can swiftly address these unexpected financial demands without disrupting your business operations or depleting your cash reserves.

These loans offer peace of mind, allowing you to navigate future uncertainties with confidence. When you have the financial support of a working capital loan, you’re better equipped to seize opportunities and navigate challenges, ensuring your business remains adaptable and resilient in the face of the unexpected.

Expand Your Initiatives

Whether you aim to launch new projects, enter untapped markets, or scale your operations, expanding your business initiatives requires a robust financial foundation.

Working capital loans can be a catalyst for your expansion endeavors. These loans offer the financial flexibility needed to pursue and fund ambitious growth strategies. Whether you’re investing in marketing campaigns, hiring additional staff, or acquiring new assets, working capital loans provide the necessary capital injection without depleting your reserves.

With the support of these loans, you can execute your growth plans swiftly and effectively, positioning your business for success in the competitive landscape.

Daily Operations

From covering routine expenses like payroll and utility bills to managing inventory and ensuring consistent service quality, daily operations demand a steady stream of capital.

These loans provide the essential liquidity required to meet operational expenses promptly, ensuring your business runs smoothly without disruptions. Whether you’re a retail store, a manufacturing facility, or a service-based enterprise, having access to working capital can make all the difference in maintaining operational excellence.

By securing working capital loans, you empower your business to maintain its competitive edge and adapt to ever-changing demands.

Essential Repairs

To maintain business vitality and minimize downtime, addressing essential repairs promptly is crucial.

Working capital loans serve as a lifeline when it comes to tackling essential equipment repairs. These loans provide the necessary financial support to swiftly mend equipment, facilities, or infrastructure, ensuring that your business can continue its operations without prolonged interruptions.

By utilizing working capital loans strategically for essential equipment repairs, you not only safeguard your business’s productivity but also protect your reputation for reliability and service excellence. Staying proactive and agile in addressing equipment repair needs can be a competitive advantage.

Minimum Requirements to Get Approved

If your business meets the minimum requirements, you should qualify for up to 8% of your annual business revenue.

Apply for a Working Capital Loan with Beacon Funding

Recently, we provided a working capital loan of $250,000 to a thriving business in Illinois, enabling them to meet their payroll expenses and continue on their path to expansion.

This substantial working capital loan allowed our customer to seize opportunities and navigate the challenges of rapid growth. With the financial backing they needed, they were well-equipped to fuel their business's evolution. Their working capital loan was not just approved swiftly, the funds were also disbursed within the same week of applying. We understand that time is of the essence when it comes to seizing business opportunities.

$250,000

|

Working Capital Loan

|

|

Approved for Expanding Business

|

|

Working Capital Loan approved and funds received within same week as applying.

|

|

|

Start your application today and pave the way for your business's expansion. Whether it's covering payroll expenses, seizing new opportunities, or taking your operations to the next level, our working capital loans are designed to empower your success.

GET STARTED NOW

Are There Alternative Options for Cash Other Than Working Capital?

Unlocking your equipment's equity can be a game-changer. Imagine having a loan that gives you full ownership, one that injects cash directly into your business by selling your equipment to Beacon Funding. If your equipment is fully owned, free from liens or titles, Beacon Funding can purchase it and then lease it back to you. You receive the proceeds from the sale, and the best part is, you can put that cash to work for your business.

Some of the advantages of Beacon Funding's Sale-Leaseback:

1. Improve Cash Flow: In business, cash is king. A sale-leaseback arrangement can significantly boost your bank balance, putting you in control of those funds to allocate as you see fit.

2. Keep Your Equipment: The equipment remains in your hands, enabling you to keep generating profits with it. You can simply transfer the title or add a lien holder to the current title in exchange for funds.

3. Reclaim Ownership: Once you've fulfilled the terms of the agreement, the lender releases their lien and transfers the title back to you. You regain full ownership, making it a win-win scenario.

The best part? You retain the ability to continue using your equipment as you see fit, leveraging it to keep those profits rolling in.

Ready to explore how a Sale-Leaseback can work for your business? Apply for one today with Beacon Funding and take a step closer to boosting your cash flow and growing your business. Don't miss out on this opportunity.

APPLY NOW FOR SALE-LEASEBACK