Launching a thriving business is an exciting journey, but it’s not without its share of hurdles.

One of the most significant challenges entrepreneurs face, whether they’re running a towing operation, an embroidery shop, or a hardscaping enterprise, is ensuring they have the right equipment to succeed. Equipment financing is a secret weapon that can make or break your early years in business.

In the first few years, every business grapples with start-up pains. Young businesses walk a tightrope, trying to maintain essential cash flow for survival while needing equipment to generate future revenue. Common hurdles include initial capital constraints, effectively navigating cash flow, and tackling the substantial costs associated with acquiring the necessary equipment.

The good news? Equipment financing can be your lifeline. In this article, we’ll delve into these challenges and explore how equipment financing isn’t just a solution, but the key to helping your start-up secure funding, maintain healthy cash flow, and acquire the essential equipment it needs to thrive.

In this article…

- Understanding Equipment Financing

- Unlocking the Advantages of Equipment Financing

- Nailing Down Your Start-up's Equipment Essentials

- Exploring Your Funding Options

- Start-up Financing Application Process

- How Financing Your Equipment Can Set You Up for Success

- The Start-up Challenge

- Apply for Start-up Financing at Beacon Funding

- Looking for Start-up Equipment Financing? Consider Beacon Funding

Understanding Equipment Financing

What is Equipment Financing?

Before diving into the equipment options, it’s essential to understand what equipment financing is.

Equipment financing is when a business borrows money to purchase business-related equipment, vehicles, or machinery. It breaks down the equipment cost into low monthly payments the borrower pays back over an agreed term-length. Financing equipment helps start-ups and established businesses get the equipment they need, lower upfront costs, and maintain a steady cash flow.

One of the greatest benefits of equipment financing is its ability to tackle two of the most common challenges in the business world:

- Maintaining a Healthy Cash Flow: Every business, from start-ups to well-established companies, grapples with the delicate art of balancing budget while ensuring operations runs smoothly. Equipment financing safeguards your cash flow by spreading out overwhelming costs into low monthly payments.

- Dealing with Substantial Equipment Costs: The costs of acquiring needed equipment can be substantial, especially for young businesses. Equipment financing acts as a gateway to spread these costs over time, making them easy to afford.

For new businesses especially, balancing a tight budget while trying to secure necessary equipment can be overwhelming. Equipment financing allows you to convert those overwhelming costs into manageable, predictable monthly payments.

Unlocking the Advantages of Equipment Financing

In the business world, where maintaining a steady cash flow is crucial, and the need for essential equipment is constant, equipment financing stands as a beacon of opportunity. It doesn’t just offer a financial solution, it’s a tool to help you tackle the challenges start-up faces.

Here’s a snapshot of what you can gain:

- Low Monthly Payments: Spread out the cost of your equipment into manageable monthly payments.

- Get Equipment Sooner: Instead of waiting to save up cash, get funding to acquire equipment today and start generating revenue.

- Flexible Payment Programs: Tailor payments to match your financial situation.

- Conserve Your Cash: Keep your cash reserves for other important business needs.

- Build Business Credit: Establishing a good payment history makes it easier to finance equipment in the future.

These advantages are more than just perks – they can be a game-changer for your business. Equipment financing isn’t just a smart choice for your financial needs, it’s a strategic tool in overcoming the challenges every start-up must face.

Nailing Down Your Start-Up’s Equipment Essentials

Before you dive into equipment financing, you’ve got to get a handle on what your start-up really needs to make the money roll in.

Identifying Equipment Financing Requirements

The journey begins by figuring out what equipment is essential for your business operations. To do this, consider these vital factors:

- Equipment’s Lifespan: Think about how long the equipment will be useful for your business.

- Technology Advancements: Keep an eye on what’s new and improved in the industry. You want equipment that stays competitive and relevant.

- Maintenance Requirements: Consider how much TLC your equipment will need to keep running smoothly. Factor in maintenance costs and schedules.

These insights will help you pinpoint exactly what you need to drive your start-up’s success.

Budgeting for Equipment

So, you’ve pinpointed what equipment your business needs. What’s next? It’s time to become a budgeting pro!

Start by creating a budget to figure out the total equipment cost. But remember, it’s not just about the equipment price tag. You also need to consider other important factors like installation, maintenance, and any potential upgrades down the road. This way, you’ll have a clear picture of how much financing you really need.

Once you know your equipment cost, you can break it down into financing payments. We suggest using an equipment financing calculator. Running the numbers can help you understand:

- What is your target monthly payment?

- Do you want to borrow the entire amount or put money down?

- For how long would you like to finance/lease your equipment?

Adjust the term length and amount borrowed on the calculator to see how it impacts your monthly payment.

Exploring Your Funding Options

When it comes to finding the right funding for your equipment, you’ve got a couple of paths to consider.

Traditional Lenders

Traditional lenders, such as banks, are one option. They do offer equipment financing but be ready for a bit of a journey. Traditional lenders usually have strict rules for approval. For example, many traditional lenders typically don’t approve businesses with under two years in business and don’t already have a substantial cashflow.

Specialized Equipment Financing Partners

Now, when it comes to equipment financing, you’ve got another ace up your sleeve – equipment financing companies.

These are the pros in the game. When traditional lenders often come with a laundry list of strict rules for approval, Beacon Funding, on the other hand, has a more flexible approach. Here’s what our team takes into account when reviewing start-up applications:

- Start-up Business Plan: Prove your plan by showing the opportunities awaiting once you have your equipment.

- Background: They look at your personal and business history.

- Industry Experience: Your knowledge and experience in the industry are considered.

- Choice of Asset: The equipment you plan to acquire matters too.

Equipment financing companies are experts at offering loans and leases for specific types of equipment. They’ve got a deep understanding of what businesses in different industries require, and they can customize financing solutions to fit your needs like a glove.

By teaming up with an equipment financing company, you’re essentially making your journey smoother. They streamline the process and increase your odds of getting that approval you’re aiming for. So, if you want a tailored solution that works for your business, these folks are the ones to talk to.

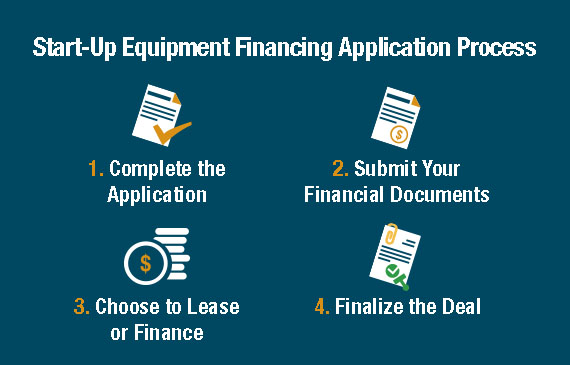

Start-Up Equipment Financing Application Process

Completing the Application

You can apply for equipment financing online in minutes. Be thorough in your application to increase your chances of approval. You can strengthen you application by putting additional cash down or collateral, adding a co-signers or guarantor, and/or sharing your business plan.

Submitting Your Financial Documents

To secure equipment financing, you’ll need to provide various financial documents. These typically include your business plan, financial statements, and tax records. Be prepared to offer personal and business guarantees, especially for start-ups with limited credit history.

Choose If You Want to Lease or Finance

Equipment financing breaks down the entire equipment cost into monthly payments. Leasing breaks down a portion of the equipment cost, and the remainder is set up as a purchase option.

Finalizing the Deal

Due Diligence and Inspections: Before finalizing the financial deal, it’s essential to conduct due diligence on the equipment. Ensure it’s in good condition and meets your specifications. Some lenders may also require inspections to verify the equipment’s value and condition.

Legal Considerations: Review the terms of your financing agreement carefully. Ensure you understand the repayment schedule. Seek legal advice if you have any questions.

How Financing Your Equipment Can Set You Up for Success

Separate Personal & Business Expenses

Your business needs cash to survive and thrive. While your personal credit is important, it can only take you so far. To truly set your business up for success, consider financing your equipment and build your start-up’s business credit.

Establishing and Building Business Credit

Beacon Funding reports to the credit agencies when you make timely payments so that you establish a strong payment reputation. When you pay back your equipment financing on time, you’re actually building a good credit history for your business. This is super important. A strong credit history for your business can open up doors to more financial help in the future.

Scaling and Future Needs

As your business grows, you’ll likely need more equipment. By establishing a good pay history with your equipment financing provider, you’re paving the way for future financing needs.

Why does business credit matter?

This is a big deal when you’re thinking about expanding your business. So, remember, the equipment you finance today can help secure a bright future for your business.

The Start-up Challenge

Here’s a startling fact: According to the U.S. Bureau of Labor, nearly 20% of new businesses don’t make it past their first two years, and a whopping 45% don’t make it past the first five years. Starting a business is tough, no doubt about it.

But guess what? There’s a way to tip the scales in your favor. With Beacon Funding’s start-up financing, you can boost your odds of success. With 7/10 businesses approved for financing, chances are good you can get the financing to take your start-up to the next level.

So, don’t let the start-up challenge intimidate you. With the right financial support, you can increase your chances of thriving in the business world.

Apply for Start-up Financing at Beacon Funding

Getting approved for financing doesn’t have to be difficult with the right lender. According to the U.S. Bureau of Labor, 20% of new businesses fail within the first two years of starting. 45% of them fail in the first five years.

That’s a lot of pressure, but with Beacon Funding’s start-up financing, you can rest assured you’ll get the needed capital to make your business thrive. Your chances of getting approved increase when you work with an equipment financing provider with a history of working with start-ups.

When it comes to finding the right financing deal for your equipment needs, Beacon Funding has a dedicated financing expert to help you.

Interested in learning more? See what steps you can do to mitigate the risk of going out of business by getting equipment and keeping your cash.

Looking for Start-up Equipment Financing? Consider Beacon Funding

Starting your business should be exciting, not a funding headache. For many, the dream of getting a business off the ground gets stalled due to a lack of funds. But, when it comes to financing the equipment you need, Beacon Funding has your back.

At Beacon Funding, we look at details other funding sources don't consider, so your new business can hit the ground running. We can help get your business started with financing for boom trucks, tow trucks, septic pumper trucks, cranes, or even decorated apparel equipment.

Why Start-up Financing?

- Wider Credit Window: Our friendly financing experts work with you to find the strengths in your credit package.

- Flexible Payment Programs: Choose a customized option that keeps cost low while you generate revenue.

- Conserve Your Cash: Keep more savings in your hands for emergencies, payroll, and other business investments.

- Credible & Trustworthy Source: With over 30 years experience, our BBB Accreditation & Google Reviews speak for themselves!

- Build Business Credit: Leverage your relationship with Beacon Funding to finance bigger and better equipment in the future.

- Equipment Expertise: Our unique knowledge of the equipment we finance means we understand the challenges you experience.

- High Satisfaction Rating: 96% of our customers would recommend us to a friend because our expert service.

- Long Term Partnership: Our flexible financing and upgrade programs are designed to grow as your business grows.

Ready to Dive In?

If you want to learn how to safeguard your business from potential failure by securing the right equipment and preserving your cash flow, Beacon Funding is here to help. Don’t hesitate to connect with our experts to kickstart your journey.

GET STARTED NOW