Adding equipment to your new business can be difficult. During its first few years, your budgets are tight, buying equipment is expensive, and generating sufficient cash flow requires a lot of dedication and time.

Without enough cash on hand, you may miss out on opportunities to take your start-up to the next level. Fortunately, you have options when it comes to getting equipment.

In this article…

- Challenges of Start-ups

- Beacon Funding’s Specialty in Start-up Equipment Financing

- Benefits of Start-up Financing from Beacon Funding

- Case Study of Start-up Financing

- Your Start-up Can Get Financing Too

Challenges of Start-ups

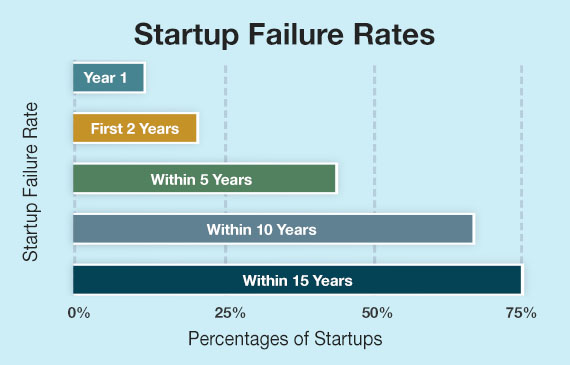

Starting a new business is not easy. It’s hard to keep operations running in the first five years. Recent studies show 10% of start-ups fail within the first year and just under 50% of them fail within the first five years.

The #1 Reason for Start-Up Failures

The top reason why start-ups close their doors? They run out of cash or failed to raise new capital, according to CBInsights. Getting initial capital is tough for young businesses, and as the journey unfolds, managing sufficient cash flow becomes a delicate balancing act.

Additional Hurdles Beyond Financing

Getting needed equipment is a challenge. The hefty costs strain tight budgets and traditional lenders add complexity with strict criteria, making it tough for start-ups to get the funds they need. And the start-up woes go beyond financing equipment.

Additional challenges include:

- Establishing a foothold in a competitive market.

- Marketing your services or products.

- Acquiring and retaining customers.

- Building a strong team.

Despite these challenges, successful start-ups who succeeded past their five-year mark found ways to turn adversity into opportunity. They embraced adaptability, resilience, and guidance to chart a course toward sustained growth and success. Solutions like partnering with an equipment financing expert helped them acquire cash for their business.

Taking Your Business from Start-up to Enterprise

Smart decisions, like financing equipment with a reputable lender who specializes in start-up financing, give your young business a fighting chance to beat the odds.

Every business needs cash to operate. However, not every young business has the cash or time to wait for the next opportunity. Instead of using all your existing cash to purchase the equipment outright, financing allows you to get equipment now and pay for it over time while earning income.

Beacon Funding’s Specialty in Start-up Equipment Financing

Many lenders only approve businesses with 3+ years of experience. As a start-up, find a lender who doesn’t have this requirement. Beacon Funding believes in giving young businesses a chance. Many start-ups prefer working with us because we look at a variety of qualifying factors besides your time in business.

Some qualifying factors include:

- Personal and Business Pay History. Have a great personal pay history, but no business credit? We also take that into account!

- Transactions Size and Conditions. Depending on how much you want to finance, we’ll help you find the best financing option for your situation.

- The Equipment. If your equipment is in our core market, there is a good chance we’ll finance it.

And yes, start-ups can qualify for equipment financing.

What makes Beacon Funding different from traditional lenders is our ability to get more deals done by getting creative in reviewing criteria.

SEE HOW TO QUALIFY

Benefits of Start-up Financing from Beacon Funding

Start-up equipment financing offers several advantages, including:

- Preserving cash flow for other business needs.

- Access to tax benefits.

- Affordable low monthly payments for better budgeting.

- The ability to own equipment at the end of the loan term.

This financing option enables businesses to acquire essential assets without depleting their working capital, which is crucial for their growth and success.

Advantages of start-up equipment financing include:

|

Wider Credit Window: Unlike traditional loans, equipment financing often has more lenient credit requirements, making it accessible to a broader range of start-ups. |

|

Flexible Payment Programs: Tailored payment plans allow start-ups to manage their budgets effectively and allocate resources to other essential expenses. |

|

Conservation of Capital: Start-ups often have limited financial resources. Equipment financing allows small businesses to preserve their capital for other essential expenses like hiring, marketing, and day-to-day operations. |

|

Predictable Costs: With a manageable fixed monthly payment for loans or lease agreements, start-ups can budget more effectively. |

|

Up-to-Date Equipment: Leasing can provide the advantage of regularly upgrading to the latest equipment models, ensuring that the business stays competitive and efficient. |

|

Tax Benefits: Equipment financing may offer tax advantages, as the interest on equipment loans and lease payments can often be tax-deductible. |

|

Long-Term Partnership: Establishing a relationship with a reliable financing partner can pave the way for long-term collaboration to get you a better deal in the future. |

Case Study of Beacon Funding Helping a Start-up Get Financing

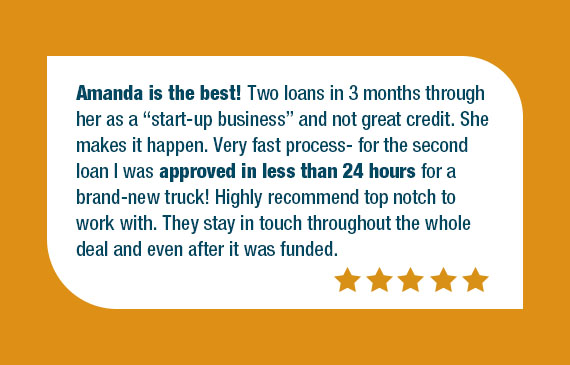

Customers are discovering how easy it is to get approved when they have little time in business. Beacon Funding’s financing consultants have a proven track record of helping businesses get approved for funding when they face obstacles.

Amanda Haraden, a Senior Financing Consultant, helped a budding towing company when they faced a similar roadblock.

Before Beacon Funding’s Help

Before seeking help from Beacon Funding, Amanda’s client aimed to expand their towing fleet by adding another truck. However, their limited time in business made conventional lenders reluctant to assist them in obtaining the necessary funding.

Additionally, credit difficulties further complicated the start-up’s situation. This had left the company in a challenging predicament.

The Solution & Results

Beacon Funding’s extended approval criteria ensured the start-up’s financing approval within 24 hours. The process was incredibly swift, with two loans approved within three months. Impressively, the second loan was approved in under 24 hours, enabling the business to acquire a brand-new truck.

Your Start-Up Can Get Financing Too

Getting equipment for your new business can be challenging, especially when you’re in the early stages of establishing your enterprise. The hurdles of acquiring necessary assets can impede your ability to capitalize on opportunities critical for your start-up’s growth.

Fortunately, with Beacon Funding, you can get a financing partner who prioritizes your success. Simply apply in minutes in just a few easy steps.

GET STARTED NOW

With a financing partner that understands the unique challenges of new ventures and offers a hassle-free financing solution, the path to success becomes clearer and more achievable. Embrace the possibilities that Beacon Funding opens up for your start-up and let your business soar to new heights with the support it deserves.