Skid steers are the superheroes of landscaping, doing all the tough jobs efficiently. These machines are key in various tasks, from digging to smoothing surfaces, thanks to their versatility. These machines make tough jobs like moving dirt or heavy materials much easier. Their small size and ability to use different tools make them a must-have for landscaping projects.

But here’s the catch: Buying a new skid steer can be expensive, ranging from $80,000 to $100,000. For young landscaping businesses with tight budgets, this hefty price tag can be a major obstacle to growth. Adding one to your business is an affordable lease-to-own option.

Money Troubles for Landscaping Businesses

Now, imagine you’re a small landscaping business trying to get ahead. The problem? It’s challenging to find the cash to buy a skid steer will keeping enough cash on hand to operate your business up. If this roadblock is stopping your businesses from growing and taking on bigger projects, there’s a solution.

Lease or Finance Landscaping Equipment

8/10 businesses opt for equipment leasing and financing because it breaks down large expenses. Instead of shelling out a ton of cash upfront businesses can lease a skid steer for a low monthly payment. This allows businesses to get their hands on a top-notch skid steer without draining their bank accounts. By using their money wisely, their able to grow sooner without hindering their day-to-day operations.

In this article, we’ll dig deeper into how leasing a skid steer works and how it can be a game-changer for landscaping businesses looking to acquire skid steers without going broke.

In this article...

- Understanding Skid Steer Costs

- Lowering Upfront Costs Through Leasing

- Advantages of Leasing a Skid Steer

- Beacon Funding’s Lease-to-Own Program

Understanding Skid Steer Costs

When it comes to adding a skid steer to your landscaping arsenal, the big question is whether to pay cash or lease. Let’s break down the costs and shed light on why leasing might be the brighter option for your business.

Skid Steer Retail Costs

Purchasing a skid steer with cash can mean a substantial hit to your budget. With price tags ranging from $80,000 to $100,000, the initial investment can be a significant barrier, especially for small or growing landscaping businesses.

Beyond the upfront expense, buying involves additional costs like maintenance, repairs, and potential depreciation. As technology advances, newer models emerge, and the value of your purchased skid steer may decrease over time. This can leave you with an outdated model, and upgrading becomes another expensive venture.

Skid Steer Leasing Benefits

Leasing offers a way to get your machine without draining your financial resources all at once. Instead of a hefty upfront cost, you make manageable monthly payments, allowing you to allocate your funds strategically.

At the end of the lease term, you can choose to upgrade to a newer model without the hassle of selling an outdated machine. This flexibility ensures that your business stays equipped with the latest and most efficient skid steer technology – or if you prefer, you can exercise your purchase option and keep your skid steer.

In a nutshell, leasing provides a cost-effective entry into skid steer ownership, offering financial flexibility, predictable expenses, and the ability to keep your equipment up to date.

SEE ALL BENEFITS

Lowering Upfront Costs Through Leasing

For start-ups and young landscaping businesses, the challenge of acquiring a skid steer can feel like climbing a financial mountain. This is where leasing emerges as a practical solution, offering a smoother ascent without the steep upfront climb.

Imagine your business is just starting out. Buying a skid steer might mean putting a significant dent in your initial capital, potentially limiting your ability to invest in other essential areas. Leasing, on the other hand, allows you to acquire the necessary equipment without the heavy financial burden. It’s like having a trusted ally that understands the challenges of starting small and provides a flexible, budget-friendly solution.

Financial Benefits of Spreading Costs Over Time

Leasing isn’t just about acquiring equipment – it’s about managing your finances wisely. By opting for a lease, you spread the cost of the skid steer over a set period, typically through monthly payments. This predictable, manageable approach to expenses frees up capital for day-to-day operations and unexpected needs.

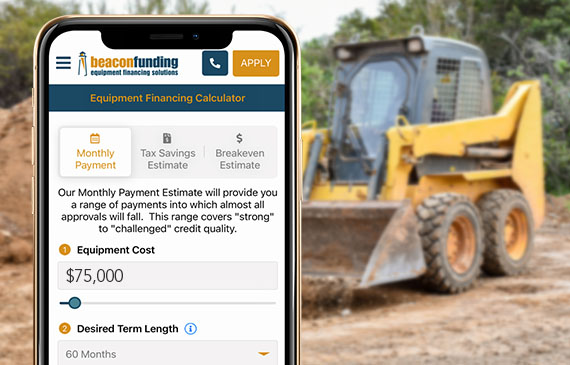

CALCULATE MY MONTHLY PAYMENT NOW

Consider it as paying in installments for a tool that boosts your business capabilities. This financial strategy aligns with the natural ebb and flow of your revenue, allowing you to grow without the strain of a large upfront payment. It’s a bit like having a financial safety net, ensuring that your business remains agile and adaptable to changing circumstances.

Advantages of Leasing a Skid Steer

Conserving Cash for Other Business Needs

Cash flow is the lifeblood of any business, especially for start-ups and young landscaping enterprises. Leasing a skid steer allows you to conserve valuable cash that can be directed towards other critical aspects of your landscaping operations.

Generating Revenues While Making Payments

Leasing empowers you to put your skid steer to work immediately, generating revenue while spreading the cost over time. Your business benefits from increased productivity and income, while you comfortably make low monthly payments.

Enjoying Fixed, Low Monthly Payments

Predictability is a powerful tool in financial planning. Leasing provides the advantage of fixed, low monthly payments, making it easier to budget and forecast. This stability allows businesses to make informed decisions about their finances, without the uncertainty of fluctuating costs.

Beacon Funding’s Lease-to-Own Program

In the equipment financing industry, Beacon Funding shines as a beacon of opportunity for landscaping businesses. Our Lease-to-Own program is designed to get a skid steer into your operations swiftly, all while offering the advantages of eventual ownership at the end of the term.

Get a Skid Steer Into Your Operations Fast

Fast-track your landscaping operations with Beacon Funding’s skid steer solution. We prioritize swift access to equipment, enabling you to boost capabilities and tackle new projects without upfront cost delays. Benefit from low monthly payments, ensuring financial health, and own the skid steer at the end our Lease-to-Own program.

Curious about how Beacon Funding’s Lease-to-Own program can work for your landscaping business? Take the first step toward skid steer ownership by exploring if you qualify.

GET STARTED NOW