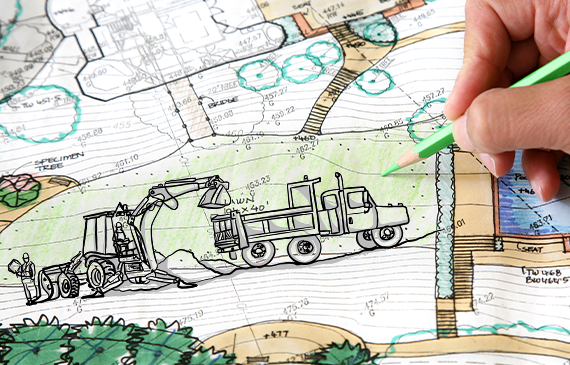

In the vast world of landscaping and hardscaping, navigating the financial terrain is as crucial as choosing the right plants for a garden. It might seem intimidating when you’re starting out, especially if you need to add equipment to scale.

In this blog, we'll explore the nuances of start-up financing for landscaping businesses. Whether you're a budding entrepreneur, understanding the ropes of financing is key to turning your landscaping dreams into reality.

We'll delve into a compelling case study that illustrates how Beacon Funding's specialized financing programs can be a game-changer for young businesses.

In this article…

- Understanding Start-up Financing

- Why Specialized Financing is Crucial

- Case Study

- Choosing the Right Financing Option

- Apply in a Few Easy Steps

Understanding Start-up Financing

Starting a landscaping business is not just about having a green thumb, it's about having the financial roots to make your business blossom.

What is start-up financing?

Start-up financing is the lifeblood for young businesses that may not have the means to buy equipment outright. A lender like Beacon Funding provides the necessary funds for acquiring essential assets, like equipment and vehicles, which your business pays for in low monthly amounts.

Equipment financing can help you get the necessary equipment without draining your savings. Not only can you gain access to funds faster, but Beacon Funding can also customize your plan to fit your unique sales cycle. If you need lower payments during your slow months, ask about seasonal payments.

Different Financing Options

Embarking on a new landscaping venture opens a world of financial opportunities, ranging from conventional loans to innovative financing solutions. When you need funds fast and hassle-free, choosing a traditional lending source like a bank might not always be the best.

To navigate this diverse financial landscape, it's crucial to align your financing choice with your business goals. Whether you're seeking a substantial injection of capital or require a swift turnaround, the key is to choose the option that best complements your specific needs.

Beacon Funding offers specialized programs tailored to the unique needs of start-up businesses, considering factors such as your industry experience, personal pay history, asset type, and start-up business plan.

Fill out our start-up financing form to see if you qualify.

Why Specialized Financing is Crucial

Landscaping businesses, require financing that goes beyond the generic. Specialized financing can be a game-changer. It addresses challenges like expensive labor and enables diversification of your product range to handle a broader spectrum of tasks.

Choosing a financing partner familiar with your equipment needs enhances your eligibility for flexible payment options. Unlike one-size-fits-all solutions, targeted and effective financing not only increases your chances of securing funds but also unlocks a realm of flexible payment possibilities, surpassing what traditional lenders typically offer.

This not only increases your chances of securing the funding you need but also opens the door to more flexible payment options—far beyond what traditional lenders might provide.

If you’re looking to land your dream contract but feel like you don’t have the right equipment for the job, we have three tips to help you get financing to close your next big job.

Case Study

Problem: A young lawncare company, less than a year old, struggling to secure funding. This is a common scenario for many start-ups in the landscaping industry.

Solution: Established a financing program with Beacon Funding, specializing in assisting businesses with challenged credit histories and startups in obtaining approvals. We successfully granted them approval for a $14,000 loan.

Plus, we were able to help them get approved for working capital within 24 hours.

Result: A triumphant moment for the lawncare company – $410 per month over 48 months, and they now own a brand-new ride-on lawnmower.

Choosing the Right Financing Option

In the vast garden of financing options, how do you pick the right one for your landscaping start-up? Tailoring financing to the unique needs of a landscaping startup.

How Does Beacon Funding approve more start-ups?

Each year Beacon Funding helps hundreds of start-ups and young businesses begin to establish their business credit and get approved for financing. Traditional banks have an approval rating of 7/10 while Beacon Funding approves 3/10.

The reason we can do this is because unlike traditional lenders we look at an extended approval criteria to help you get the funding you need.

Beacon Funding Looks At:

- Your start-up business plan

- Personal credit history

- Equipment being picked

- Your industry experience

SEE IF YOU QUALIFY

Improve Your Chances of Getting Approved

Here are a few things you could consider when looking to get approved:

- Adding a co-signer, additional cash down, or collateral can increase chances of an approval.

- Working with Beacon Funding can help you building business credit to help you fund bigger and better equipment in future.

- Include a start-up business plan to highlight how you’ll be successful.

Check out our comprehensive video to learn more about improving your approval chances!

WATCH VIDEO

Apply in a Few Easy Steps

Don’t waste time with a financing partner who won’t approve your business. And because we specialize in 24-hour approvals, you’ll get quick answers with our hassle-free process. With thousands of happy customers and over $1 billion worth of equipment financed, you can rely on us to help scale your business and acquire revenue-generating equipment.

APPLY NOW