Did you know you may be eligible for a tax deduction when you lease qualified equipment? That’s right!

In this article, find out the tax write-offs you can take advantage of when you lease equipment with different types of leases.

In this article…

- Can You Write Off Equipment Lease Expenses

- Differences Between Capital and Operating Leases

- How Much Can You Save on Your 2024 Income Taxes?

- Recap of Potential Tax Benefits for Leasing Equipment

Can You Write Off Equipment Lease Expenses?

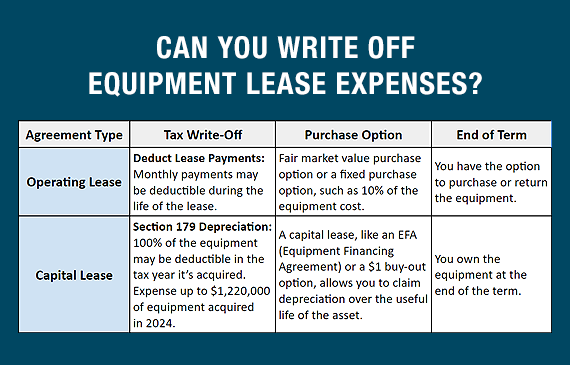

Yes! There are two ways to write-off expenses when you lease equipment: Capital Lease vs. Operating Lease. This drastically lowers the overall cost of adding new equipment to improve your business.

Whether you prefer to lease or finance, your business could save thousands using these tax write-off options.

Let's breakdown the differences between these two types of agreements.

Differences Between Capital and Operating Leases

Capital Lease

A capital lease is like a contract that grants you ownership of an asset. From an accounting standpoint, this lease is treated as if you outright own the asset, and it’s recorded on your financial statements accordingly.

This is crucial because the IRS requires you to own the property to use depreciation as a deduction. The good news is, if you have a capital lease, such as an Equipment Financing Agreement (EFA) or a lease with a $1 buy-out option, you’re able to claim depreciation over the useful life of the asset.

CALCULATE YOUR POTENTIAL TAX SAVINGS

Quick tip: If you’re utilizing a capital lease, have a chat with your tax advisor about optimizing your tax deduction through Section 179. You could potentially write-off the entire purchase price in the same tax year you acquire the equipment.

Operating Lease

An operating lease is more like a rental agreement that allows you to use an asset without actually owning it. This type of lease often comes with options for a fair market value purchase or a fixed purchase amount, typically around 10% of the equipment’s cost.

APPLY FOR LEASE-TO-OWN

How Much Can You Save On Your 2024 Income Taxes?

See a breakdown of your potential tax savings of two different $50,000 equipment purchase scenarios.

|

Type of Agreement

|

Operating Lease

|

Capital Lease

|

|

Tax Write-Off

|

Deduct Lease Payments: Monthly payments may be deductible during the life of the lease.

|

Section 179 Depreciation: 100% of the equipment may be deductible in the tax year it's acquired. Expense up to $1,220,000 of equipment acquired in 2024.

|

|

Tax Savings Example

|

|

|

|

Lease Structure

|

$55,000 worth of equipment on a 36-month lease with FMV 10% purchase option.

|

$55,000 worth of equipment on a 36-month lease with $1 buyout.

|

|

Monthly Payment

|

$1,632/month

|

$1,838/month

|

|

Projected 2024 Tax Savings

(Assuming 35% Tax Bracket)

|

$6,854

([$1,632 x 12 months] x 35 percent)

|

$19,250

($55,000 x 35 percent)

|

|

Projected 2025 Tax Savings

(Assuming 35% Tax Bracket)

|

$6,854

([$1,484 x 12 months] x 35 percent)

|

$0

|

|

Projected 2026 Tax Savings

(Assuming 35% Tax Bracket)

|

$6,854

([$1,484 x 12 months] x 35 percent)

|

$0

|

|

Projected Total Tax Savings

|

$20,562

|

$19,250

|

*All examples provided herein are for illustrative purposes only. Actual numbers will vary based on tax brackets, lease payment amount, and individual financial situations.

Recap of Potential Tax Benefits for Leasing Equipment

In summary, capital leases grant ownership of an asset and are treated as such on financial statements, allowing for depreciation deductions. It’s essential for claiming tax benefits, particularly through Section 179. On the other hand, operating leases function more like rental agreements, providing the use of assets without ownership.

These leases often include options for purchasing the asset at fair market value or a fixed amount. Understanding the distinctions between these two lease types is crucial for making an informed financing decision.