Bonus depreciation continues to ramp down in 2024. Like last year, bonus depreciation is on track to phase out by 2027. There’s still time to use this tax benefit!

In this article…

- How It Works

- Bonus Depreciation in 2024

- Timeline to Phase Out Bonus Depreciation by 2027

- Take Advantage of 60% Bonus Depreciation in 2024

- Applying for Bonus Depreciation

- The Sooner You Start the Financing Equipment, The Better

How It Works

When you acquire equipment for your business, you can deduct up to $1,220,000 using Section 179 in 2024. The deduction phases out when a business purchases more than $3,050,000 in one year. Once you hit the Section 179 deduction limit, you may also qualify for Bonus Depreciation.

Bonus Depreciation 2024

This year bonus depreciation is set at 60% (a 20% decline since last year). Businesses can deduct 60% of the cost of certain assets in the first year they are acquired and placed into service.

Equipment that may qualify for this tax deduction includes tow trucks, screen printing and embroidery equipment, landscaping equipment like skid steers, compact track loaders, mini-excavators, and other heavy machinery.

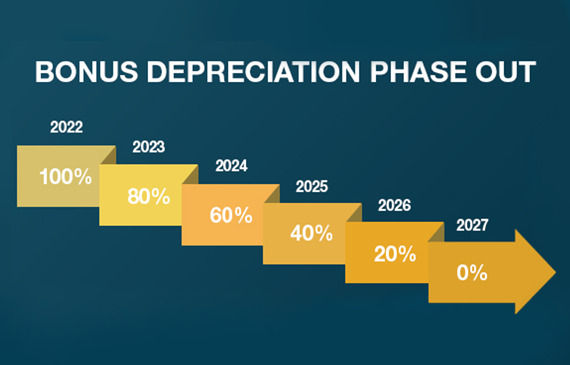

Timeline to Phase Out Bonus Depreciation by 2027

As of 2024, the rate for this tax deduction will decline by 20% over the next three years until it is no longer available.

Take Advantage of 60% Bonus Depreciation in 2024

To use bonus depreciation this year, business equipment must be acquired and used before January 1st, 2025. If you’re reading this article before that deadline, there may still be time for you to utilize this deduction’s full benefit before it decreases by another 20% next year.

Make sure to consult with your CPA or tax advisor prior to adding equipment to discuss the tax savings for your business.* If you are looking to add equipment to take advantage of bonus depreciation talk to one of our friendly financing consultants.

Get answers about tax deductions for equipment financing by talking with a financing expert. *

SCHEDULE A CALL

* Bonus depreciation details are complex, so be sure to consult your tax adviser!

Applying for Bonus Depreciation

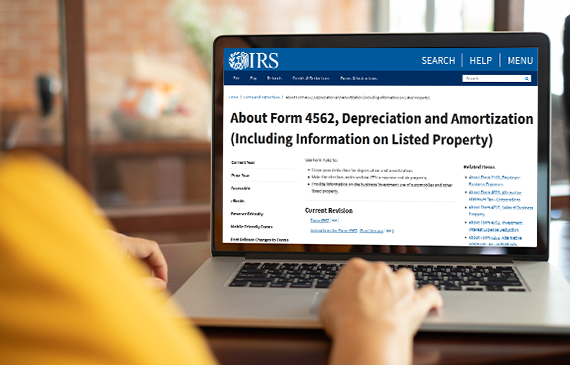

To file for bonus deprecation, you can use IRS’s Form 4562. This form can also be used for other types of depreciation and amortization. It is highly recommended to review the form’s instructions.

Pro Tip: Check your state to see if you qualify before you begin any depreciation calculations.

Advantages of Bonus Depreciation

The main advantage of bonus depreciation is for businesses planning to purchase a significant amount of equipment for their operations. If this is your case, you can accelerate your tax deduction to benefit now.

Get More of Your Money Back

- There is no annual limit, no matter how much equipment you acquire each year.

- You can take the deduction, even if it creates a loss for tax purposes.

- The government is rewarding you for growing your business, so take advantage of it!

You Should Know: For any year you elect bonus depreciation, you must take the deduction for the full cost of all assets of the same tax asset class acquired that year. For example, all 5-year assets, but since the election is made annually, taking the deduction in one year does not affect your ability to elect, or not elect, it in the next year.

The Sooner You Start The Financing Process, The Better

Keep this in mind if you plan to finance equipment this year: The benefit of bonus depreciation applies only to equipment purchases in the same calendar year.

The sooner you start the process of financing equipment, the better. Odds are you will not only rest assured equipment will be available, but more likely you’ll receive tax incentives before the year ends.

START MY PRE-APPROVAL NOW