In this article, see a quick breakdown of the strategic advantages of building your business credit to get you more favorable terms in the future and 5 tips to work smarter, not harder this year.

Are you looking for more efficient ways to grow your business in 2024? Use these 5 essential tips to work smarter, not harder in 2024 with equipment financing.

Building business credit provides your enterprise with financial flexibility, improves your access to funding solutions, and other benefits. A positive business credit history helps your business grow by qualifying for a wider variety of financing opportunities and the ability to secure the most competitive funding.

Actively managing and enhancing your business credit enhances your financial standing, improving the likelihood of favorable loan terms and increased credit limits.

In this article…

- 3 Reasons You Should Work Towards Building Your Business Credit in 2024

- Choosing the Right Lender for You

- 5 Tips for Working Smarter, Not Harder

- Build Your Business Credit with Beacon Funding

3 Reasons You Should Work Towards Building Your Business Credit in 2024

What is business credit? Business credit refers to the creditworthiness of a business. Opening a business credit card, getting a business loan, or financing equipment all help you establish a line of business credit. Paying on time strengthens your company’s profile.

If you want to grow faster, establishing strong business credit can set you up for success in 2024 and beyond.

Let’s look at the top three reasons why establishing business credit is essential if you plan to expand and grow your business to a meaningful size.

1. Access to More Capital

Let’s face it – growing your business requires cash. Whether it’s buying equipment, handling unexpected costs, or investing in your operations, your business needs funds for growth.

Establishing a solid business credit profile enhances your ability to secure financing for expansion, equipment purchases, or unforeseen operational expenses. In a dynamic business landscape, having access to capital can be a game-changer, allowing you to seize opportunities and navigate challenges with confidence.

2. Boost in Credibility and Trustworthiness

A robust business credit history instills confidence in lenders, suppliers, and potential partners with your company.

As your business’s creditworthiness grows, so does its reputation for financial responsibility. This not only facilitates smoother transactions but also opens doors to larger lending limits that can contribute to your business’s growth. Here’s why:

- As your business scales, you’re going to need access to more funds and better cost control.

- As your business takes on more work and acquires more customers, you’re going to need to purchase equipment.

- With a strong business credit score, lenders will see you as a reliable client and may offer you more flexible repayment structures.

As an equipment financing leader for the past 30 years, we can tell you 100% that the earlier you build business credit and reap these benefits, the better for your company.

3. Boost in Credibility and Trustworthiness

We get it – using your personal credit card to pay for business expenses is convenient. However, using your personal credit puts your business at a disadvantage. Not to mention, it can put your personal assets at risk.

Too often, business owners rely on personal credit to finance equipment. The reality is there is always a chance your business could hit tough times. Using personal credit can put you personally at risk if you can’t pay it back. You wouldn’t want that debt reflected on your own personal credit report.

Building business credit helps you establish a clear distinction between personal and business finances. Separating the two is crucial for protecting your personal assets and ensures the long-term financial health of your business. It also positions your business as a distinct entity, reinforcing its credibility in the eyes of creditors.

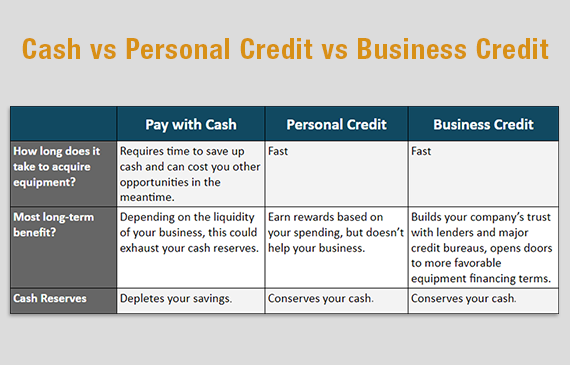

Comparison between Paying with Cash vs. Personal Credit vs. Business Credit

Choosing The Right Lender for You

Selecting the right lender is a critical step in the process of building your business credit. Partnering with a lender who takes the time to understand your business goals, like Beacon Funding, makes a significant difference in your credit-building journey.

Most general lenders want to see your business be successful for 2+ years before offering your company financing, and not just put it on your personal credit. Because Beacon Funding understands how important it is for your company to build credit as early as possible, we do not require your business to have a certain amount of time in existence before offering credit.

Working With An Experienced Lender

Collaborating with an experienced lender like Beacon Funding can expedite this credit-building process, ensuring a robust foundation for your business’s financial journey.

For over 30 years, Beacon Funding has helped tens of thousands of businesses establish their business credit by financing over $1 billion equipment since 1990. Our mission is to help small to medium-sized businesses – even start-ups – finance and acquire the equipment they need to grow.

SEE IF YOU QUALIFY

Relationship Building

Building a strong relationship with your lender goes beyond transactional interactions. A positive and communicative relationship can lead to more favorable terms in the future.

5 Tips for Working Smarter, Not Harder

With over 33+ years of experience, we have compiled 5 tips that could benefit businesses before acquiring your next piece of equipment, including:

1. Don’t Deplete Your Working Capital

Preserving your capital is paramount. Keeping your funds intact ensures that you have a financial cushion in case of unforeseen challenges and opportunities.

Maintain a positive cash flow in your business. Use equipment financing to conserve your cash and get your equipment for a fixed, low monthly payment.

CALCULATE MY MONTHLY PAYMENT

2. Scale Faster by Building Your Business Credit

Acknowledging the significance of a commendable pay history, building your business credit is a pivotal strategy. This not only paves the way for more favorable financing terms in the future but also serves to gradually reduce the cost of funds over time.

As your business builds credit over time, its reputation with lenders becomes stronger and more secure. This puts your company in a better position to acquire needed assets to grow and expand profitably. If your company needs more equipment to generate more revenue, strong credit gives you the ability to finance equipment under more favorable terms.

3. Reduce Costs by Financing Used Equipment

Financing used equipment not only lowers upfront expenses but also proves to be a financially prudent choice in the long run, allowing your business to allocate resources judiciously.

The best part? You can also finance used equipment to spread out your expenses.

Learn more about used equipment financing here.

4. Work with a Lender You Can Trust

When it comes to financing your equipment, entrusting your investments to a long-term lending partner is a strategic move. At Beacon Funding, we pride ourselves on being more than just a lender – we are your trusted financial partner committed to helping your business succeed.

By partnering with a lender with a long history like Beacon Funding, you position your business for a secure and stable future. Our commitment to trust and transparency ensures that you not only experience smoother transactions but also gain access to more favorable terms and conditions.

5. Strengthen Your Application to Improve Your Approval Chances

Enhancing your application is a proactive step toward securing approval for equipment financing. By presenting a robust application, you not only exhibit financial responsibility but also increase the likelihood of approval.

Let these 5 tips serve as a compass and guide your business toward a more strategic and efficient approach to growth. Whether preserving working capital, building credit, optimizing costs, selecting a trustworthy lender, or fortifying your application, use these insights to empower your business.

Build Your Business Credit with Beacon Funding

Everyone has to start somewhere. When you’re set on establishing business credit, it pays to work with an equipment lender that has your goals in mind. Unlike traditional lenders, Beacon Funding is comfortable helping companies that haven’t established business credit yet.

For more than 30 years, Beacon Funding has helped tens of thousands of businesses grow and expand with equipment financing. If you want to work smarter in 2024, contact us today – your success is our #1 priority.