This article was written by Daniel Nubie, a Business Development Consultant at Beacon Funding. As a consultant, Daniel works with business owners to help them grow their operations using equipment financing options tailored to their situation.

The path towards equipment ownership is easier than you think. If you’re looking to lease equipment with the goal of ownership in mind and learn about the amazing potential tax benefits of lease-to-own, then this article is for you.

In this article...

- Six Key Benefits of Lease-to-Own

- How Does Beacon Funding's Lease-to-Own Work?

- Apply Now for Lease-to-Own

Six Key Benefits of Lease-to-Own

1. Tax Write-offs

You don’t have to purchase an asset outright to save on income taxes.

Lease-to-own may allow you to write-off most or all your monthly payments as a business expense when you file your taxes. This can dramatically lower your business’s income tax bill and essentially keep more cash in your pocket.

Example of Tax Savings with 10% Purchase Option

When you write-off your lease’s monthly payments, you could dramatically lower your business’s income tax bill – essentially keeping more cash in your pocket.

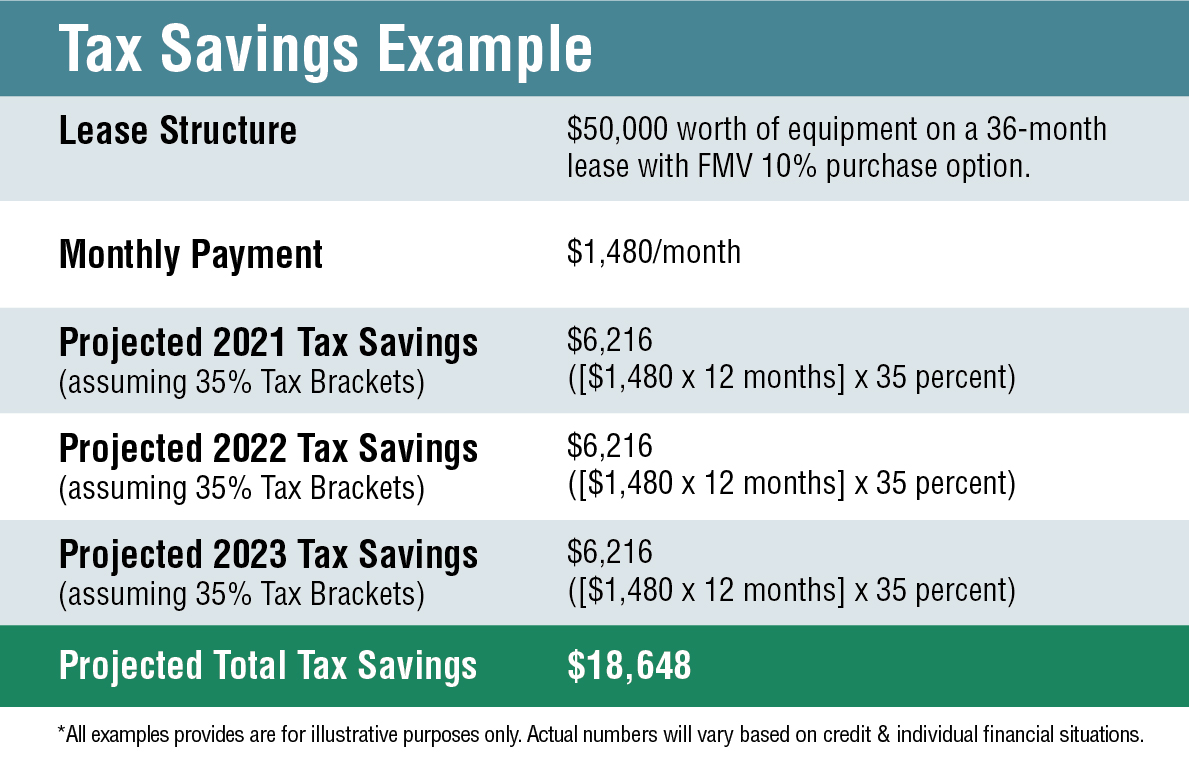

For example, a lease structured with a 10% purchase option allows you to deduct your lease payments on your tax return. Here’s a detailed example of how much tax savings you could receive with an equipment piece worth $50,000 on a 36-month lease with a 10% purchase option.

2. Sales Tax

An additional bonus is how you pay sales tax.

Normally, buying an expensive equipment asset includes paying sales tax at the time of your purchase. Depending on where you live, sales tax can either be paid upfront or as part of your monthly payments so your business has flexibility into how you decide to pay sales tax.

Important: When it comes to how you file your taxes, talk to your CPA about what will work best for your business.

Want to see how this may apply to your business? Schedule a quick chat with me to learn how a lease may work for your business.

3. Maintain Cash Reserves

It may seem easier to pay for equipment with cash, but lease-to-own offers more benefits to your business than simply buying equipment with cash.

Leasing allows you to conserve your cash for times you need it most rather than spending it all on expensive equipment. You’ll be able to keep your cash for things such as:

- Operating expenses

- Building an emergency fund

- Invest in areas of your business that diversifies your revenue stream

- Other things you can’t finance like payroll or marketing.

Best of all? You’ll have equipment in your business earning profits. Think of the opportunities you’d miss out on if you simply saved up enough cash to buy the equipment.

4. Mitigate Risk While Turning a Profit

The reality is many businesses fail because they simply run out of cash.

Commercial equipment continues earning profits even after a loan is repaid, unlike a personal car and homes. The fixed payment essentially makes it like having an employee on payroll rather than just another expense.

With a fixed low monthly payment that fits into your budget, you’ll make one powerful step towards keeping enough cash to ensure you keep your business running for long-term success.

5. Lower Upfront Cost of Equipment

When you lease equipment, you’ll notice your profits should increase over time.

Despite paying a monthly lease payment, you'll soon discover more cash flowing into your business than going out. This boost in revenue will become significantly noticeable after your lease is over and you own your equipment free and clear.

6. Gain Ownership

When I talk to customers about lease-to-own, they’re hesitant. Why? Because they’d rather buy equipment and own it immediately.

That’s understandable, but businesses that pay everything with cash may be missing out on benefits unique only to leasing. Even better, lease-to-own is designed with ownership in mind and isn’t really different than any other financing product.

Case Study: A Real-Life Example of Lease-to-Own

For a lot of my customers, benefiting from the Lease-to-Own program and its tax write-offs has helped them get a head start in their business expansion. The cash they saved on their taxes is then used to purchase upgrades, making it easier to get bigger and better equipment.

For example, I had one customer lease a brand-new tow truck in the fall. Leasing allowed him to save big when he filed his taxes the following spring. He then used his tax savings to finance two more brand new tow trucks the following April and May.

In a little less than nine months, my customer went from constantly breaking trucks to acquiring three new dependable ones. That allowed him to service a lot more customers, hire more drivers, and ultimately generate much more revenue than had he waited to save up enough cash.

Apply Now for Lease-to-Own with Beacon Funding

The truth is a lease-to-own program is a great step towards equipment ownership. If you want equipment immediately with the possibility of receiving amazing tax benefits, then equipment leasing may be right for you.

SCHEDULE A MEETING NOW

The first step is talking with an expert. Schedule a time to meet me about getting an equipment lease that fits your business – I can help your business get on the path towards equipment ownership sooner than you think.