Tax season is arriving sooner than you might believe. As the end of the calendar year gets closer, it’s important to think about your tax write-offs for your 2022 return.

In this article…

- Section 179 Deduction Explained

- Calculate Your Potential Section 179 Tax Savings

- Normal Depreciation vs. Section 179

- Requirements For Section 179

- Get Needed Equipment Faster With Equipment Financing

Section 179 Deduction Explained

What many businesses don’t know is that you can qualify for a deduction just for financing qualified trucks and equipment.

Rather than depreciating smaller portions of the equipment cost over several tax years, you can accelerate your deduction with Section 179. Write off 100% of the purchase price (up to $1,080,000) the year you finance it!

Section 179 not only saves your business money, but also reduces the cost of the equipment you purchase when you receive a larger deduction with a Section 179 tax benefit. That way, you can keep more cash in your pocket to invest in your business.

Check out this video to get a quick breakdown of how Section 179 works.

Calculate Your Potential Section 179 Tax Savings

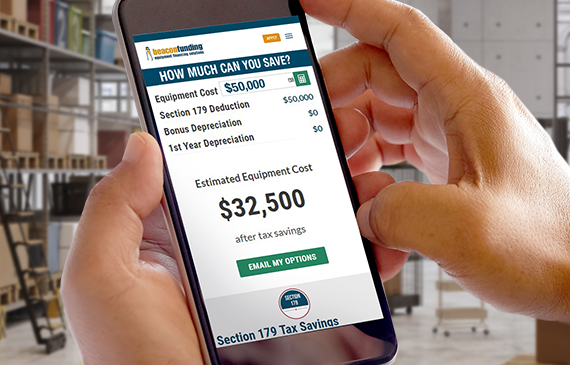

Wondering what amount of tax savings you can expect from purchasing equipment? Find out with Beacon Funding’s tax savings calculator.

Enter the cost of your equipment and immediately get an estimate on your tax savings. Your business can potentially save thousands just for purchasing and using it before 2022 ends.

Want to calculate your potential tax savings on the go? Download the free mobile app for your mobile phone Google Play or the App Store.

Normal Depreciation vs. Section 179

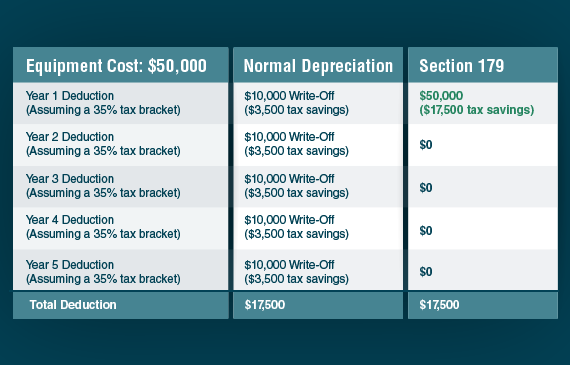

Unlike normal depreciation, Section 179 allows your business to deduct all or part of the purchase price during that same tax year of an equipment purchase.

Let’s do a quick comparison between the two ways you can deduct your equipment’s purchase cost.

Imagine you just purchased a piece of equipment for $50,000.

Scenario 1: Normal Depreciation

Normally, you would write off a portion of the equipment’s cost each year, spreading your tax benefits in small increments during that equipment’s “useful life.”

Then, let’s say you use that piece of equipment for five years – that would give you a $10,000 deduction each year for five total years.

Scenario 2: Section 179

Instead of writing off the equipment’s cost over five years, you would deduct the entire $50,000 in the same year you purchased it.

While deducting a little at a time is beneficial, many businesses prefer to receive total tax benefits upfront. Unlike other depreciation methods, Section 179 helps accelerate tax deductions and receive them immediately.

Requirements for Section 179

To be eligible to use Section 179 benefits, there are a few conditions you should be aware of.

1. Equipment must be purchased and in use before December 31st 2022

Start the process sooner than later. It might take some time for you to get the equipment you want.

Make sure there’s enough time for you to use your equipment before the calendar year ends. Don’t risk the equipment you want not being available, built, or delivered on time.

2. Eligible equipment

Both new and used equipment qualify. Everything from heavy-duty equipment, business vehicles, office furniture computer, and off-the-shelf software may be eligible.

As with any tax-related questions, consult your CPA before purchasing to determine if the equipment you want qualifies for the Section 179 tax deduction.

3. Equipment needs to be used for business 50% of the time

Put your equipment in operation before the deadline. Remember, you must have the equipment in your possession and used before the December 31st deadline.

The sooner you get your equipment, the more likely you can use this tax benefit to keep cash in your business.

Get Needed Equipment Faster with Equipment Financing

At Beacon Funding, we want to see your business succeed. And when it comes to fast and easy equipment financing, we’ve helped tens of thousands of businesses finance over $1 billion in equipment.

Interested in getting equipment sooner than later for your business? Apply today and receive a same-day response from a financing consultant. We’ll help you get a heads start on getting equipment so you’ll have plenty of time before the deadline for Section 179 tax benefit approaches.

* As always, make sure to consult with your certified public accountant (CPA) or tax advisor before any equipment purchases. That way, you can discuss what’s best for your business.