Looking for a smart way to scale your business and improve your 2024 tax situation? Equipment financing could be the solution you’ve been looking for.

Under Section 179, your business may unlock accelerated tax advantages while helping your business get state-of-the-art equipment. Keep reading to find out 2024’s Section 179 deduction limit.

In this article...

- Section 179 Deduction Limits for 2024

- Calculate Your Potential 2024 Tax Savings in Seconds

- Requirements for Section 179

- Normal Depreciation vs. Section 179

- You May Qualify for a Tax Deduction by Financing Equipment in 2024

- Four Advantages of Pairing Equipment Financing with Section 179 Deduction in 2024

Many businesses are unaware that financing qualified equipment might make them eligible for a tax deduction. Rather than spreading out the depreciation of equipment costs over several years, Section 179 enables you to accelerate your equipment’s deduction and claim it in the first year you acquire it.

Section 179 Deduction Limits for 2024

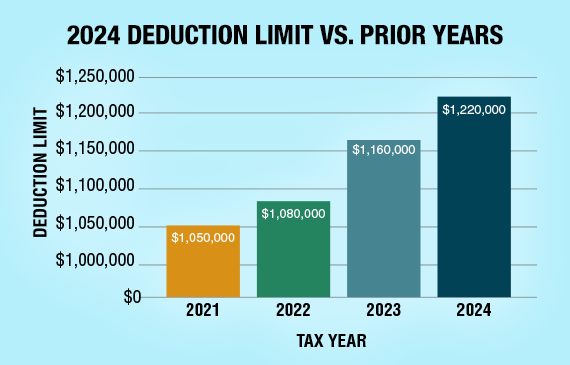

In 2024, the Section 179 deduction limit has been raised to $1,220,000 (an increase of $60,000 from 2023). This means your business can deduct the entire cost of qualified equipment up to a total equipment purchase limit of $3,050,000.

If your business acquires equipment between January 1st to December 31st and uses it 50% of the time for your business before the end of the year, you can deduct it under Section 179.

Calculate Your Potential 2024 Tax Savings in Seconds

You can expense 100% of the cost of equipment you acquire in 2024 under Section 179.* If you plan to finance equipment before the end of the year, you may be able to benefit from this tax deduction.

How much could you save?

That’s where our FREE calculator comes in. By simply telling us a few details, you can calculate how much you can deduct using Section 179. Don’t miss out on potential tax savings – use our calculator to see your potential income tax savings when you finance equipment this year.

CALCULATE HOW MUCH I CAN DEDUCT

Plus, if you buy equipment over $1,220,000 and put it into service by December 31st, you may qualify for Bonus Depreciation.*

*Bonus depreciation details are complex, so be sure to consult your tax adviser!

Requirements for Section 179

By financing qualified equipment and combining it with a Section 179 2024 tax deduction, you may be able to save more money for your business.

To be eligible to use Section 179 benefits, there are a few conditions you should be aware of.

1. Equipment must be purchased and in use before December 31st 2024

Start the process sooner than later. It may take some time for you to get the equipment you want.

Make sure there’s enough time for you to use your equipment before the calendar year ends. Don’t risk the equipment you want not being available, built, or delivered on time.

2. Eligible equipment

Both new and used equipment qualify. Everything from heavy-duty equipment, business vehicles, office furniture computer, and off-the-shelf software may be eligible.

As with any tax-related questions, consult your CPA before purchasing to determine if the equipment you want qualifies for the Section 179 tax deduction.

3. Equipment needs to be used for business 50% of the time

Put your equipment in operation before the deadline. Remember – you must have the equipment in your possession and used before the December 31st deadline.

The sooner you get your equipment, the more likely you can use this tax benefit to keep cash in your business.

Normal Depreciation vs. Section 179

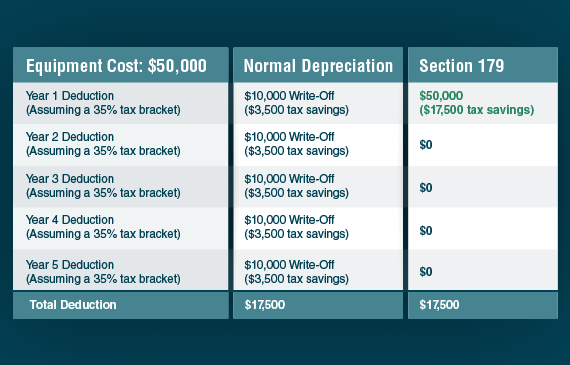

Compared to normal depreciation, Section 179 permits your business to deduct all or a portion of the purchase price in the same tax year as the equipment purchase. This not only saves money for your business but also reduces the equipment’s overall cost, thanks to the larger deduction provided by the Section 179 tax benefit.

You may be eligible to write off the entire purchase price (up to $1,220,000) the same year you finance qualified equipment! This way, you retain more cash to reinvest in your business.

Let’s quickly compare the two methods of deducting your equipment’s purchase cost.

Scenario 1: Normal Depreciation

Traditionally, you would gradually write off a portion of the equipment’s cost each year, spreading out your tax advantages over the equipment’s “useful life”.

For instance, if you use the equipment for five years, you’d claim a $10,000 deduction annually for a total of five years.

Scenario 2: Section 179

Instead of spreading the equipment’s cost over five years, you would deduct the entire $50,000 in the same year you purchase.

While incremental deductions have their benefits, many businesses prefer to obtain their tax advantages upfront. Unlike conventional depreciation methods, Section 179 accelerates tax deductions, providing immediate benefits.

You May Qualify for a Tax Deduction by Financing Equipment in 2024

Understanding the significance of a Section 179 tax deduction for your business is crucial. This tax advantage offers a powerful means to enhance your business’s profitability while enabling investment in essential equipment for success.

How Does Section 179 Work?

When businesses invest in themselves by adding equipment, it sparks job creation. Subsequently, there’s a ripple effect leading to heightened wages and payroll taxes across businesses engaged in equipment manufacturing, sales, and using the equipment.

For a deeper understanding of how this tax advantage works, watch the video below. Don’t forget to subscribe to our YouTube channel for more insights into tax benefits associated with equipment financing.

4 Advantages of Pairing Equipment Financing with Section 179 Deduction in 2024

By integrating swift and hassle-free equipment financing with Section 179 tax benefits, your business gains a more streamlined approach to incorporating equipment into your financial plan. This empowers you to:

- Optimize your cash flow

- Expediate your income tax advantages

- Preserve more cash and maintain open lines of credit for future expansion

- Have a clear understanding of your monthly equipment expenditures

Remember: To qualify for Section 179, equipment must be operational before the close of 2024. If the equipment you’re considering has a delivery lead time of several months, plan ahead to ensure it’s available before the deadline. Apply today to get a head start.

As the industry leader in equipment financing, Beacon Funding is ready to help you get the necessary equipment with affordable monthly payments tailored to your business requirements.

APPLY NOW