Looking to acquire multiple equipment units at once? It can be a daunting task to manage multiple monthly payments and stay on top of your finances. Fortunately, there is a solution that can save you money on your monthly budget while keeping it simple with one monthly payment.

This solution is called Wrap Financing.

In this article, you will see the benefits of wrapping equipment leasing together, how it can lower existing monthly payments, and provide examples of wrap equipment leasing in action.

In this article…

- Benefits of Wrap Financing

- How a Wrap Lease May Be Perfect for Your Growing Business

- Example of Wrap Financing in Action

- How Wrap Financing May Lower Existing Monthly Payments

- Choose the Right Lender for Your Wrap Financing

Benefits of Wrap Financing

There are many benefits to wrapping multiple leases together. Here are three of the most significant advantages:

- Grow your business faster: By combining equipment financing, you can acquire more equipment and grow your business faster. This allows you to keep up with demand and expand your operations.

- Add more business equipment by leveraging the equity in the equipment you already have: You can add more equipment to your existing deal by tapping into the equity of your current equipment. This makes it easier to finance additional equipment and keep up with the needs of your growing business.

- Keep your monthly payments low: By combining multiple payments into one, you can lower your monthly payments and make it easier to manage your finances. This can save you money and reduce the stress of managing multiple payments.

How a Wrap Lease May Be Perfect for Your Growing Business

Growing your business quickly may be easier. Wrap leasing allows customers to tap into their existing equipment’s equity to finance additional equipment. This means that a customer can add more equipment to their existing deal without having to take out a new loan or lease.

This can be especially beneficial for businesses that need to expand their operations or keep up with demand.

Here’s how it works:

When a customer finances equipment, they make monthly payments towards the equipment’s purchase price. As they make these payments, they build equity in their equipment.

Equity is the difference between the equipment’s value and the amount owed on the loan or lease. For example, if your equipment is valued at $50,000 and you have $40,000 remaining on your current note, you would have $10,000 in equity.

With wrap leasing, you can use this equity to finance additional equipment. Instead of taking out a new loan or lease, you can add new equipment to your existing deal and make one monthly payment. This allows you to keep your monthly budget in check and avoid the hassle of managing multiple payments. Additionally, you can often negotiate better terms than you would on an individual loan or lease.

Example of Wrap Financing in Action

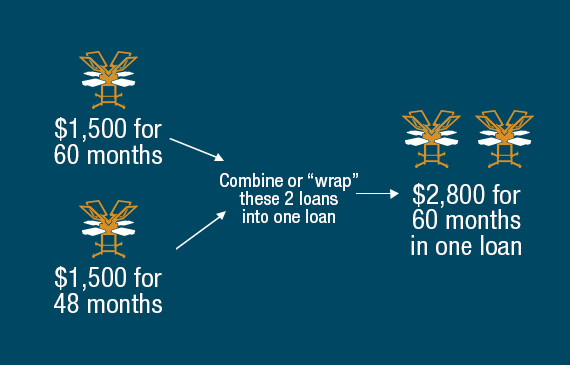

Wrap leasing is similar to refinancing where you “wrap” a new piece of equipment into an existing lease.

Let’s say you have a loan for a screen press that costs $1,500 a month for 60 months. After twelve months, you need another machine to keep up with demand. Instead of making two payments every month – one for 48 months and one for 60 months – you could combine them into one payment of $2,800 per month for 60 months.

This will make it easier for you to manage your monthly budget and save some money.

Important: Wrap financing is not always clean-cut and involves multiple factors. The following example was a simple version for educational purposes and may not apply to everyone. Beacon Funding's Wrap Programs are primarily geared toward screen printing and embroidery equipment. If you want to know whether wrap financing is right for you, apply today.

APPLY FOR WRAP FINANCING

How Wrap Financing May Lower Existing Monthly Payments

Wrap leasing is a popular financing option in the decorated apparel industry. This is because business owners can take advantage of high-value equipment like embroidery machines and screen presses, which retain their value over long periods of time.

Benefits of Wrap Financing

This makes it easy for them to leverage equipment they are already financing to lease another machine. You can benefit from manageable monthly payments, growing your business faster, and conserving cash.

Instead of juggling multiple payments, they can use wrap leasing to combine all payments into one monthly payment. This makes it easier to manage finances and save money on their monthly budget.

Choose the Right Lender for Your Wrap Financing

When searching for an equipment financing option for your business, you don’t have to do it alone. It’s important to work with a lender who understands the value of your business’s equipment and can help you leverage it for achieving your business goals.

While other lenders might deny you because you don’t fit in their financing structure, Beacon Funding has a wider credit window than most. That’s how we’re able to approve 7/10 applications.

If you’re ready to wrap multiple leases together, apply today. Applying takes a few minutes, has no cost or commitment, and you’ll receive a response from a financing consultant within 24 hours.