Every year (the week before December 31st) I get a few calls from panicked business owners because they need to finance and take delivery of an equipment purchase before the end of the year.

Typically, these calls are due to the business owner’s tax advisor telling them that they need to claim Section 179 tax depreciation this year… or be faced with writing a significant check to Uncle Sam for income taxes next year.

What is Section 179? (How to pay $0 Income Tax on your 2020 Profits)

A Section 179 tax depreciation write-off is the U.S. government’s way of stimulating the economy. When businesses are encouraged to invest in themselves, and with more equipment in the economy, jobs are created. Then, there is a corresponding increase in wages and payroll taxes from the businesses manufacturing, selling, and using the equipment. Simply: Equipment gets manufactured, sold, then used. It’s a win-win-win for employees, employers, and the government.

If your business purchases equipment by December 31st, you can legally avoid paying federal income taxes on your 2020 profits. This simple, yet true tax benefit (under IRS Section 179) allows 100% of equipment cost to be depreciated in the year acquired against that years’ business profits.

How to Calculate Section 179 Depreciation

By using Beacon Funding’s Section 179 Tax Savings Calculator, you can see how much you could potentially save when you utilize this tax benefit. How will you use your section 179 tax depreciation? Do you need to replace worn out equipment? Or should you add equipment to your growing business?

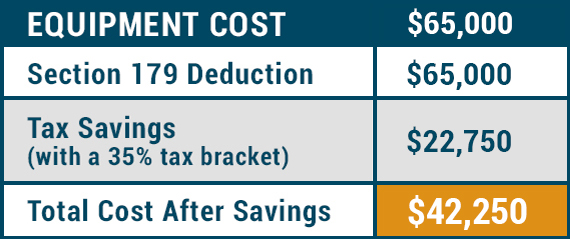

Here is an example: Meet Tom. He’s a hard worker like you. Tom needs to add a used $65,000 tow truck due to increased business. Because Tom is in the 35% tax bracket, he’s eligible to save up to $22,750 in taxes by acquiring equipment in 2020 as follows:

So, if Tom has $65,000 or more in 2020 taxable income, he can write-off the entire cost of the tow truck and not pay $22,750 in 2020 income tax. Since this $22,750 in profits has been earned and Tom does not have to pay it to Uncle Sam, he will keep it in his bank account.

If Tom financed the purchase of this tow truck for… let’s say, $1,260/monthly payments, he can use that $22,750 in cash savings to pay his next 18 monthly financing payments, essentially reducing the cost of that tow truck by $22,750!

Does New or Used Equipment Qualify for Section 179?

Yes, new or used equipment qualifies for this cash savings Section 179 depreciation.

And yes, even if the new or used equipment is financed, it qualifies for the Section 179 depreciation cash savings. Please note that leased equipment does not qualify for the Section 179 tax benefit.

Section 179 Tips and Details!

- Section 179 Depreciation is limited to $1,000,000 (adjusted for inflation each year) but do not fear if you are fortunate enough to have more than that in 2020 profits, there is also “Bonus Depreciation” available.

- Bonus Depreciation details are complex, please consult your tax advisor!

- Equipment must be put into service by December 31, 2020 to qualify.

- Be aware that equipment sales people have sales volume goals that they need to meet by yearend!

- Combining the use of equipment financing and Section 179 tax benefits is a powerful “cash in your pocket” tool.

Act Now, Save More (Using Section 179 Tax Write-Off for 2020)

Since we are approaching the end of the year, now is the time to determine if your business can benefit with a 2020 Section 179 tax write-off. Consult with your professional tax advisor as soon as possible so that you do not miss this opportunity to keep cash in your business rather than paying income taxes to Uncle Sam.

When you combine simple, easy, and competitive equipment financing with Section 179 tax benefits, it’s easier to fit new or used equipment into your 2020 budget now before the year end rush and risk that the equipment you want is not available until next year!

Remember: Equipment must be in use before the end of the year to qualify. If the equipment you are looking at takes a few months to deliver, plan ahead to make sure it is available before the deadline. Get started on a no cost or obligation, pre-approval for financing now to be ready for your tax advisor telling you that you need equipment in service this year, or be faced with writing a significant check to Uncle Sam for income taxes next year – OUCH!

Have any questions on Section 179? Don’t hesitate to contact at 847-897-2491 or [email protected]. I am happy to help! Also, always contact your trusted tax advisor for specifics on how Section 179 tax benefits apply to your business tax situation.