*Beacon Funding has been an expert in financing bucket, boom, and crane trucks for over 15 years. For the purpose of this article, we will be referring to all boom, bucket, crane trucks and their variations as boom trucks*

Raise Up Your Operations with the Right Answers

Acquiring a boom truck is a financial hurdle you need to overcome if you want to start generating profitable revenue.

Finding the right funding partner and the right boom truck that’ll last is important to the long-term success of all boom truck owners. We consulted with a boom truck financing expert to get you quick answers to the top 5 most common questions that business owners should ask before buying their boom truck.

About Our Expert

As a leader in equipment financing and leasing, Bob Dubow began his career in the industry as a Certified Public Accountant, where he audited several leasing companies. Before joining Beacon Funding in 2007, Bob became a financing expert by owning and operating his own equipment leasing and financing business. Today, he uses his proven track record to help companies grow.

With over 25 years in the financing and leasing industry, Bob’s industry knowledge can help you grow your business into success by financing your next boom truck with no surprises, fine print, or double talk.

Have questions about equipment financing or how it can take your business to its next level? Ask Bob a question via phone, text, or email!

Phone: 847.897.2491

Text: 847.208.4530

Email: [email protected]

Top 5 FAQ About Owning and Financing a Boom Truck

- What’s the optimal way of getting a boom truck in today's competitive market?

- What’s important when considering a used boom truck?

- What are safety and maintenance certifications to keep in mind?

- What is an affordable option to incorporate a boom truck into a growing business?

- What are the perks of financing a boom truck?

1. What’s the optimal way of getting a boom truck in today's climate?

With today’s competitive climate, finding a boom truck that fits your specifications is definitely not easy. The disruption of computer chips for medium to heavy-duty auto manufacturers in the global supply chain has led to a fall in the supply of trucks.

This has left new boom trucks in low supply and dried up the inventory of used boom trucks. Taking this into account, the best way to acquire one is to shop around and put a deposit down as soon as possible. You can do that by considering the following:

- Research: It’s important to research the variety of options when considering a truck that’s right for your business. It might not be easy to find a boom truck that fits your specifications right off the bat with today’s supply shortages. In addition to letting your preferred, dealer-licensed, boom truck salesperson know what you are looking for, you may want to also consider private party sellers as well. There are some additional risks associated with buying from a private party but with the proper due diligence, you can often mitigate those risks.

As an added plus point, Beacon Funding is one of the few lenders in the country that can help you finance equipment from a private-party seller. Schedule a quick call with our expert and you can learn how to opt for this financing plan.

Put a deposit down: It may seem like a sales line, but putting a deposit down on a new truck order or a trade-in coming in soon is the reality of today’s limited availability of boom trucks. Gone are the days when you can get a dealer to hold a truck because you said you are going to buy it tomorrow.

A pre-approval for your equipment is a great tool to give your business the advantage of confidently putting a deposit down on the boom truck before someone else does.

If the need arises and you’re unsure on what model you would like to invest in, Beacon Funding will pre-approve you for the funding you need. Learn more about what it means to be pre-approved for financing here.

2. What’s important when considering a used boom truck?

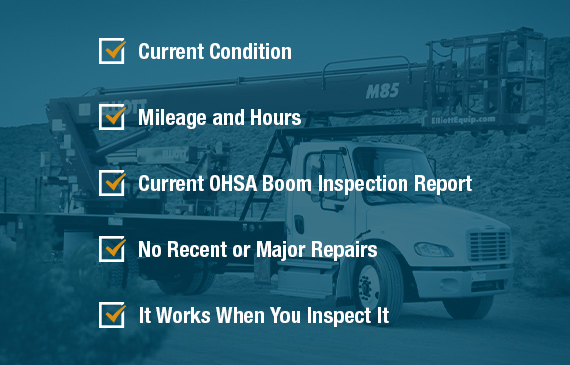

It’s important to look at the following factors:

- The condition of the chassis and also the condition of the boom.

- Mileage and hours are important to get the best approval terms.

- Make sure the boom truck has a current OHSA Boom Inspection Report (less than a year old).

- Check to see if there were any recent or major repairs on the boom truck.

- Inspect it and operate it yourself to see if it reaches your requirements.

3. What are safety and maintenance certifications to keep in mind?

It is important to check for the specific certifications required for each truck before you invest in one. As a good starting point, please refer to the OHSA (Occupational Safety and Health Administration) requirements and research your individual state’s requirements for boom truck operations. There you will find guidelines. Then invest in the proper training for your staff.

4. What is an affordable option to incorporate a boom truck into a growing business?

Equipment financing can put you in the fast lane towards getting the boom truck you need.

In today’s tough market, Beacon Funding understands boom trucks are in high demand and need to move quickly. With equipment financing pre-approvals and funding in as little as 24 hours, we can quickly help you get your hands on your next boom truck before it’s gone.

Use our free low monthly payment calculator to estimate your potential payments.

5. What are the perks of financing a boom truck?

At a time when inflation is significant and equipment is scarce, being in a liquidity crunch is not ideal. It’s important to have enough funding to maintain a strong cash flow and expand your business with the equipment you require.

Waiting for enough cash to invest in a boom truck may prevent you from seizing opportunities to grow your customer base and profits. Financing your next boom truck could open doors for you to invest in your business with low monthly payments, while your boom truck pays for itself, and it doesn’t break the bank. Plus, your financed boom truck opens the door to tax deductions and establishing business credit.

What should my next step be?

In today’s competitive market, timing is everything. Being prepared to act on getting a boom truck when you need it is one of the best things you could do. The sooner, the better to grow your business.

Consider options that allow you to stay in a positive state even before the opportunity presents itself- get pre-approved.

Getting pre-approved for financing allows you to get the funding commitment you need, subject to finding the right equipment, at no cost or obligation to you. Beacon Funding will give you all the detailed terms upfront based on your desired funding amount. No surprises, fine print, or double talk! We also can help you understand which chassis and/or boom you might want to stay away from in order to avoid a potentially costly repair or rebuild situation.

Schedule some time to speak about how financing can help you grow your business, today.

Let’s connect!