How it Works

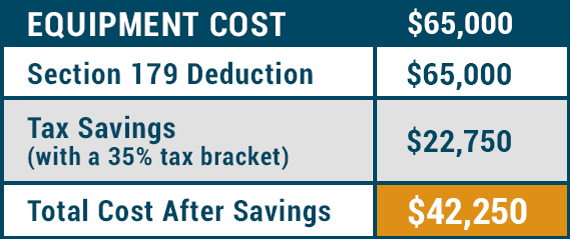

Typically, when your business acquires equipment, tax deductions are realized over the useful life of the equipment. With IRS Section 179, your business is likely able to write off the entire equipment purchase the year in which it is acquired. Unlike normal depreciation, IRS Section 179 helps to accelerate tax deductions so your business benefits now. Look at this example:

For larger equipment purchases of over $1,000,000 your business may also benefit from bonus depreciation. For example, if you finance equipment costing $1.5 million dollars, one million of that may be eligible for through Section 179. The remaining $500,000 may be eligible for 100% bonus depreciation. See how Section 179 applies to you and your business with our handy calculator.

Now let’s get into the nitty-gritty of the Section 179 Tax Deduction and Bonus Depreciation.

Section 179

The Section 179 Tax Deduction allows a business to deduct all or part of the purchase price of certain qualifying equipment that is purchased, leased, or financed during that tax year. The deduction can result in substantial savings on your new equipment cost. This incentive was put into place to motivate small businesses to invest in themselves through acquiring equipment. You can increase your business’ efficiency while putting money back into your pocket; it’s a win-win.

On 01/01/2019, the IRS Section 179 deduction limit increased to $1,000,000. This change was outlined in the Tax Cuts and Jobs Act. The limit applies to new and used equipment. To take the deduction for tax year 2019, the equipment must be financed or purchased and put into service between January 1, 2019 and the end of the day on December 31, 2019.

Section 179 does come with limits – the 2019 Spending Cap on equipment purchases is $2,500,000.This limits the total amount of the equipment purchased to $2,500,000. In other words, once a business acquires more than $2,500,000 of equipment in a year the deduction begins to phase out. With these limitations, IRS Section 179 is a true “small business tax incentive” preventing large corporations from taking advantage.

Bonus Depreciation

So you’ve reached the 179 spending cap - what happens next? Once you’ve surpassed the spending cap, bonus depreciation comes into play.

Bonus depreciation allows businesses to deduct a certain percentage of the cost of eligible equipment purchases the year they acquire them, rather than depreciating them over a period of years. This year, Bonus Deprecation remained at 100%, which has doubled since 2017.

Section 179 savings can change each year, so to optimize your savings frequently check our page for updates.

What Section 179 Means for You

As a small business owner, these new changes make 2019 a great year to expand your business by acquiring more equipment. The increased limits mean most small businesses will be able to take advantage of the benefits. By combining the Section 179 tax benefits with financing, attaining new or used equipment can more easily fit into your 2019 budget. To see what your tax savings could be, check out our tax savings calculator. Put money back into your pocket sooner with Section 179 tax savings!

Learn more about Section 179 is and how it traditionally helps businesses expand.