Showing your worth to a banker or lender can be difficult when you don't have the years of experience or capital to back you up. Luckily when banks say no, it’s not the end of the road for you.

At Beacon Funding, we look at criteria other funding sources don't consider, so your new business can get equipment and hit the ground running. As industry experts with 31 years of experience, we understand your industry and can offer better start-up equipment financing options.

Here are three reasons why you should finance your first piece of equipment with Beacon Funding’s start-up equipment financing program.

3 Reasons to Fund Your Equipment With Start-up Equipment Financing

- Budget-Friendly Low Monthly Payments

- Conserve Cash

- Build Business Credit

Budget-Friendly Low Monthly Payments

Ensuring your bills are covered by the revenue you generate each month is a top priority for every business. As a start-up, finding areas to minimize expenses can free up more cash to invest in growth. Start by opting to finance equipment instead of paying cash.

Financing breaks down the burden of adding equipment over a period of time into low monthly payments. The extra benefit of financing equipment is you can start using it to generate revenue. As your business ramps up demand, your equipment can start paying for itself.

Start-ups should also consider longer financing term to decrease the monthly payment. The lower your payments and the higher your return, the more cash you’ll have on hand to grow.

Monthly Payment Tools

Beacon Funding’s team specializes in listening to a company’s business goals to determine the best low monthly payment plan that fits into your budget.

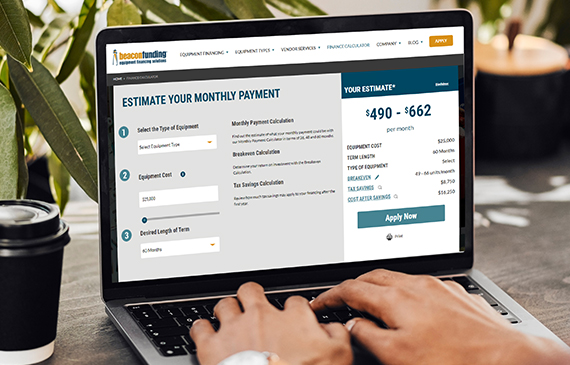

Our free equipment financing calculator can help you visualize what equipment fits into your budget. Estimate your low monthly payments here.

CALCULATE NOW

Conserve Cash

Every business needs cash to operate because payroll and utilities are not optional expenses. However, not every young business has the cash or time to wait for the next opportunity.

According to CBInsights, one of the top reasons why start-up businesses fail is due to lack of capital and cash flow. Equipment financing can help you get equipment fast so you can pump cash into your business. 82% of small business fail due to cash flow problems.

Fortunately, start-up equipment financing can help your company get the equipment it needs to grow sooner. Instead of using all your existing cash to purchase the equipment outright, financing allows you to get equipment now and pay for it over time while earning income.

Here are some ways Beacon Funding’s equipment financing can help your business:

- Save Time: Get approved for the equipment funding you need in 24 hours.

- Maintain Your Liquidity: Helps conserve your cash resources for when you need it most.

- Achieve Equipment Ownership: Our leasing options were designed to allow your business to own its equipment at the end of your financing term.

- Earn As You Finance: Generate a revenue by putting your equipment to work before you even pay it off.

Build Business Credit

One reason why start-ups choose Beacon Funding as their trusted financing lender is because we can help you establish a business credit history.

Some start-up owners still use their personal credit for business-related purchases, which puts their personal assets at risk. Beacon Funding can help relieve the burden on your personal credit by opening another line just for your business.

How Beacon Funding Makes It Easier to Qualify for Equipment Financing

We’re Equipment Experts. Because of our specialty in our core niche markets, we’re able to help businesses get the equipment that needs it.

No Age Restrictions on Equipment. We can approve both new and used equipment financing. If the equipment is in good working condition and being sold at a fair price, we can help you get the equipment financing you’re looking for.

Looking Beyond A Credit Score. Beacon looks at a bunch of criteria besides your credit history; other factors we consider include collateral values, pay history, and trade references.

You want a lender that’s familiar with your business and provides the most competitive option to grow your business effectively.

How To Get Start-Up Equipment Financing

Beacon Funding believes in giving young businesses a chance. That’s why we look at a variety of qualifying factors besides your time in business. We also consider:

- Personal and Business Pay History. Have great personal pay history, but no business credit? We’ll also take that into account!

- Transactions Size and Conditions. Depending on how much you want to finance, we’ll help you find the best financing option for your situation.

- The Equipment. If your equipment is in our core market, there is a good chance we’ll finance it.

And yes, start-ups can qualify for equipment financing. What makes Beacon different from traditional lenders is our ability to get more deals done by getting creative in reviewing criteria.

As a reputable lender that’s financed over $1 billion in equipment since 1990, we’re committed to helping businesses find the right financing for their situation.

Apply for Equipment Financing Today with Beacon Funding

Ready to start your journey today with equipment financing that’s just right for you? Set your start-up on the path towards success with equipment financing – it only takes 15 minutes to apply online.

GET STARTED TODAY

Beacon Funding approves 7/10 businesses for equipment financing regardless of their time in business

Since 1990, Beacon Funding has provided start-up businesses with low affordable equipment financing they need. Our financing consultants can also work directly with your business to tailor the right plan to match a tight operating budget.

It all starts with a quick conversation. Once we understand your needs, we can suggest the right financing plan to help you achieve your business goals!

CHAT WITH A CONSULTANT TODAY