Running a business offers little to no time for waiting. When you need equipment as soon as possible, you need answers fast. But what if you don’t have the cash to get equipment?

Even worse, what if you are left waiting to get your application approved?

Equipment financing stands out from traditional lending by offering you a fast way to get funds for equipment when you need it. But not all lenders are alike! Don’t waste valuable time jumping through hoops applying everywhere. The best way to evaluate which lender is worth your effort is to understand their application process and standard turnaround time.

Watch the video or read the whole article to peek behind the curtain of Beacon Funding’s fast equipment financing process.

If you want to skip the reading, talk with a financing consultant today to see how you can get equipment financing sooner rather than later.

Talk with a consultant today: www.beaconfunding.com/benefits

Apply for financing: www.beaconfunding.com/apply

How Does Equipment Financing Work to Quickly Grow Your Business?

Applying for a loan can take a lot of time, costing your business opportunities. When you need to move quickly, equipment financing offers a fast turnaround to get equipment for your business. Here’s how:

- Completing a financing application takes less than 10 minutes.

- Instantly submit your bank statements with hassle-free secure electronic verification.

- Receive an answer on your credit application within 24 – 48 hours.

After you apply for equipment financing, Beacon Funding takes care of the rest. Your dedicated rep will work to get you the quickest turnaround time possible.

Get Equipment in Your Hands Much Faster

When you have an opportunity to grow your business, you need equipment that gets the job done quickly. In those moments, you don’t have the time to waste saving up cash.

With equipment financing, you can get the funds to afford the equipment you need to expand now. That means you can cut down on your waiting time and set yourself on the straight path towards equipment ownership.

And because you can get 24-48 hour credit decisions, you can make business decisions much faster. Beacon has helped thousands of businesses nationwide quickly acquire the funds to get equipment that works for them.

Application Built for Your Business Convenience

The old days of applying with paper are over. Finally, it’s easy to apply for equipment financing – it only takes a couple of minutes to apply!

When you apply, you can instantly use tools like Decision Logic to send over your bank statements from your mobile phone. Just click a link, enter your information, and then you’re done! How easy is that?

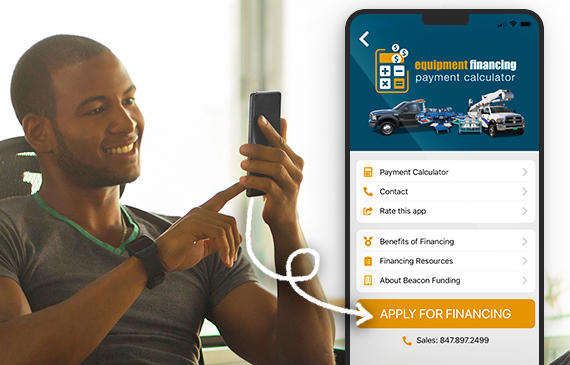

You can also apply from Beacon Funding's mobile app. Click here to download it for free.

Move Your Business Forward Quickly

With equipment financing, it’s realistic to go from application to acceptance in 2-3 business days. And it’s all done in six simple steps. Here’s how it works:

- Application

- Discuss Expectations

- Approval

- Approval Letter

- Documentation

- Delivery & Acceptance

In these six simple steps, you’ll go from application to equipment ownership in a snap. Start growing your business and get a quick turnaround for your equipment financing when you apply at beaconfunding.com/apply

Have Questions? Get Fast Answers When Your Business Needs Them

For over thirty years, Beacon’s dedicated financing consultants have become experts on changing the way business owners apply for financing. They’ve made the process seamless for customers to get answers when they need them.

Reach out to us and you’ll see why Beacon’s customers describe our process as flawless. Schedule a time to chat at www.beaconfunding.com/benefits