Businesses often miss great tax-saving opportunities because they aren’t aware certain tax breaks exist.

Under Section 179, you can write-off 100% of the purchase price of the equipment you finance up to the yearly deduction limit. If you purchase equipment over the deduction limit of $1,080,000, you may qualify for bonus depreciation.

What is bonus depreciation? Technically it is additional equipment you can deduct after you exceed the Section 179 deduction limit. Let’s look at this tax incentive and how your business can take advantage of it when you finance your next equipment purchase.

In this article…

- Calculate Your Potential Tax Savings

- How To Get A Bigger 2022 Tax Refund

- How Do I Apply for Bonus Depreciation?

- Is it Too Late To Claim My Section 179 Deduction?

- Bonus Depreciation for 2022

- The Benefits of Equipment Financing

Calculate Your Potential Tax Savings

Want to see how much your deductions stack up quickly? Calculate your Section 179 deduction and see how much bonus deprecation your equipment financing could save you.

Download the FREE app on AppStore or Google Play.

How To Get A Bigger 2022 Tax Refund

When you purchase a qualified asset and put it to use you might be eligible to take a Section 179 deduction to reduce the purchase price itself. You can take the additional 100% bonus depreciation of the remaining basis.

Bonus depreciation allows businesses to deduct the cost of eligible purchases the year they acquire them rather than spreading the cost over time. As long as you use your equipment the majority of the time for your business, that long-term asset is tax-deductible.

Key Takeaways

- Bonus depreciation allows businesses to deduct the cost of eligible purchases the year they acquire them (rather than spreading the cost over time).

- You can file for bonus depreciation with IRS Form 4562.

- Check your state to see if you qualify for Bonus Depreciation.

How Do I Apply for Bonus Depreciation?

To file for bonus depreciation, use IRS’s Form 4562. This form can also be used for other types of depreciation and amortization. We highly recommend reviewing the form’s instructions.

Check your state to see if you apply before you begin any depreciation calculations.

Is It Too Late To Claim My Section 179 Deduction If I Purchased Equipment in 2019 and 2020?

If you acquired equipment in the last 3 years and didn’t take a Section 179 deduction, you may be eligible to receive money back with an amended return.

If you think this happened to you, you can file an amended return for 2019 or 2020 if you forgot to claim a tax credit or deduction. To claim a refund, file Form 1040X no more than three years from the date you filed your original tax return.

Learn more about the pros and cons of filing an amended return in this useful article from the IRS. Talk to your accountant if submitting a 1040x Form is in your best interest.

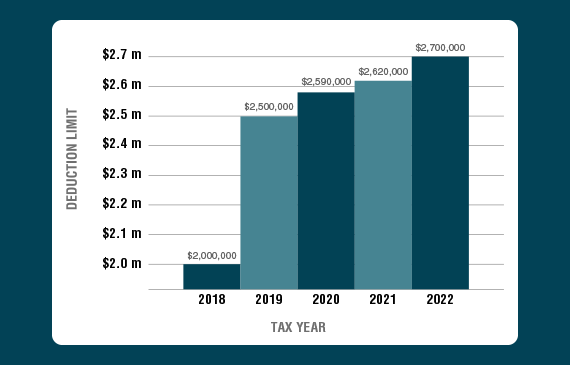

Bonus Depreciation for 2022

|

2022

|

2021

|

2020

|

2019

|

2018

|

|

Deduction remains at 100% with a spending cap on equipment purchases up to $2.7 million.

|

Deduction remained at 100% with a spending cap on equipment purchases up to $2,620,000

|

Deduction remained at 100% with a spending cap on equipment purchases up to $2,590,000.

|

Deduction remained at 100% with a spending cap up to $2,500,000.

|

Deduction increased to 100% with a spending cap up on equipment purchases up to $2 million.

|

The Benefits of Equipment Financing

When your business needs equipment fast to match with tax benefits to lower your equipment cost, trust a leading lender with experience. Beacon Funding has financed over $1 billion in equipment since 1990.

Apply today and receive a same-day response from a financing consultant, so you can see how these benefits of bonus depreciation might work for you:

- Conserve Cash: Finance the new or used equipment you need for a low monthly payment.

- Earn As You Finance: Put the equipment to use earning revenue for your business.

- Tax Savings: Write off the FULL purchase price of the equipment on your 2022 income tax return.

Remember: Bonus depreciation benefits apply only to equipment purchases in the same calendar year.

That means the sooner you plan ahead for equipment financing, the better chance of not only guaranteeing the equipment is available for purchase, but the more likely you’ll receive tax incentives before the year ends!