Starting a new business is an adventure. Let’s face it – lack of capital is often a big hurdle for growing a start-up business. Having access to more capital and using it wisely is a key to success.

With little-to-no experience, it can be difficult for young businesses to obtain equipment financing. At Beacon Funding, it remains our goal to provide startup businesses with the quick, convenient, and competitive equipment financing they need … even when traditional bank financing may not be available.

Here are four ways equipment financing can help your business grow.

1. Acquire Equipment Quicker & Conserve Cash

Every business needs cash to operate because payroll and utilities are not optional expenses. But not every young business has the cash or time to wait for the next opportunity.

Fortunately, start-up equipment financing can help your company get the equipment it needs to grow sooner. Instead of using all your existing cash to purchase equipment outright, financing allows you to get equipment now and pay for it over time while earning income.

Here are some ways Beacon Funding’s equipment financing can help your business now:

-

Maintain Liquidity – Keep more cash on hand for incidentals and expenses.

-

Achieve Ownership – Beacon’s Lease-to-Own program will allow your business to own its equipment at the end of your financing term. Finance equipment and build equity!

-

Earn As You Finance – Put your equipment to work while earning revenue for your business.

2. Establish Business Credit

As a startup business with less than two (2) years of history, you might think equipment financing is out of reach. Beacon Funding is a specialist in working with startups and assists young businesses in establishing business credit history. Our clients can then use this business credit history to seek out additional financing options in the future.

Some start-up owners still use their personal credit for business-related purchases. When business owners don’t separate their expenses, this could potentially hurt their personal credit if something unexpected occurred. Beacon Funding can help relieve the burden on your personal credit by opening another line just for your business. Here’s how:

- We’re Equipment Experts in Decorated Apparel. Beacon knows your equipment inside and out. Because of our specialty in our core niche markets, we’re able to help screen-printing and embroidery businesses get the equipment that needs it.

- No Age Restrictions on Equipment. As equipment experts, Beacon Funding is able to approve both new and used equipment. If the equipment is in good working condition and being sold at a fair price, Beacon Funding can help you get the equipment you’re looking for.

- Looking Beyond A Credit Score. Beacon looks at a bunch of criteria besides your credit history. Some other factors we take into account include collateral values, pay history, and trade references.

You want a lender that’s familiar with your decorated apparel business and provides the most competitive option to grow your business effectively.

Because of our equipment expertise in the decorated apparel industries, Beacon Funding is able to approve +7 out of 10 applications including start-up businesses.

3. New Businesses Can Qualify

Beacon Funding believes in giving young businesses a chance. That’s why we look at a variety of qualifying factors besides your time in business. We also consider:

- Personal and Business Pay History. Have great personal pay history, but no business credit? We’ll also take that into account!

- Transactions Size and Conditions. Depending on how much you want to finance, we’ll help you find the best financing option for your situation.

- The Equipment. If your equipment is in our core market, there is a good chance we’ll finance it.

What makes Beacon different from traditional lenders is our ability to get creative. When you work with one of our expert financing consultants, Beacon can help craft a transaction that best meets your business needs.

4. Save Money and Finance Used Equipment

When you’re looking for quality equipment, don’t overlook buying used. Used equipment is a cost-effective way to increase your product input without breaking the bank.

As an expert in equipment financing, Beacon Funding is able to approve both new and used equipment. As long as it’s in good condition, we can help you get used equipment financing that can help you:

- Save on costs. If you’re looking to keep costs low, used equipment could potentially save your business thousands. You can acquire reliable equipment that can affordably help you grow.

- Fit into your budget. Used equipment financing can help break down the cost of equipment to low monthly payments. By paying for it over time, you can put the equipment to work earning revenue - that will help it even pay for itself!

Quality online retailers, like Equip-Used.com, will thoroughly inspect their equipment to make sure your start-up purchases reliable equipment to help get your revenue flowing.

How To Get Equipment Financing

Ready to take your start-up to its next level? Growing your young business is hard enough, but Beacon is here to support your growth.

As a reputable lender that’s financed over $1 billion in equipment since 1990, we’re committed to helping businesses find the right financing for their situation.

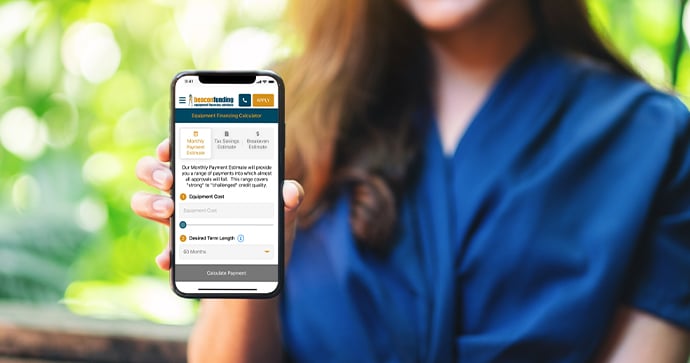

Start today by looking at your equipment’s monthly payment with Beacon’s equipment finance calculator. Take the guesswork out with Beacon’s newest mobile app.

See how affordable your next decorated apparel equipment could be by downloading the app on Google Play or on the App Store.

Apply For Equipment Financing Today with Beacon Funding

Ready to start your journey today with equipment financing that’s just right for you? Set your start-up on the path towards success with equipment financing – it only takes 15 minutes to apply online.