It’s 2023, and small businesses have to be careful about how they use their working capital in the post-pandemic world. The good news is that there is more than one way to acquire equipment without spending a lot of money. So, will Section 179 go away in 2023? Well, the phase-out slash expense limit of Section 179 has become a permanent element of the tax code.

In this article...

- The Importance of Equipment Financing for Tax Savings: An Objective Look at Section 179

- A Look at Section 179

- 2023 Deduction Limits in Section 179

- What are the Section 179 requirements?

- Learn to Calculate Section 179 Potential Tax Savings

- Leverage Beacon Funding to Get Immediate Equipment Financing

As a small business, if you decide to leverage the financing option to buy a new piece of equipment, you can then benefit from a single tax write-off. It works as Section 179, which is now part of the internal revenue code. Today, it makes practical sense to opt for a Section 179 tax deduction.

Section 179 may sound technical and full of technical details, but it is easy to understand than you think and offers significant savings benefits.

Keeping that in mind, let’s dive into the basics of Section 179, how it works, what its requirements are, and how you can calculate Section 179 for potential savings:

The Importance of Equipment Financing for Tax Savings: An Objective Look at Section 179

Mostly, tax season knocks on the door sooner than business owners realize. As the end of the year draws near – it gets more important to write off your annual taxes.

What’s startling is that many businesses are unaware of the fact that they’re eligible for tax deductions when they finance qualifying equipment.

When you use Section 179, it doesn’t just allow you to save business funds – it also helps you reduce the equipment costs that you acquire to run and grow your business operations.

The key is to make sure you lease, purchase, or finance equipment before December 31. After that, use the Section 179 tax deduction on your return so that you can have more cash for your business operations.

When you take out this tax deduction within the same year as you buy equipment, it makes you eligible to get a more significant tax deduction in the form of Section 179.

A Look at Section 179

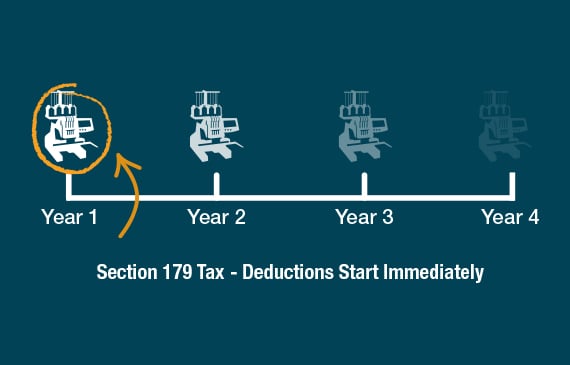

Section 179 works as a part of the IRS tax code that makes it possible for businesses to deduct their equipment costs in the year they bought the asset. This is a significant money-saving benefit as compared to depreciation.

When you use Section 179, it allows you to deduct your equipment cost immediately. Ordinarily, the equipment costs would’ve been deducted and capitalized over the years.

Mechanics of Section 179

This incentive was set in motion by the United States government to influence businesses to invest more in their enterprises and acquire modern equipment to optimize their operations and drive growth. For instance, if you plan to buy new laptops or desktop PCs for all your employees, you will need to take out a portion of every computer’s cost for years to follow the depreciation rules.

But with Section 179, you can make prompt tax deductions that cost you a fraction of the cost. Most importantly, you can use Section 179 for a deduction in the same year. This eliminates the need to keep an eye on the depreciation of each computer.

When it comes to vehicle write-offs, Section 179’s impact is significantly reduced. Still, whether it’s machinery, vehicles, or office equipment, small business owners need to realize and recognize the significance of deducting the cost in the same year.

Section 179 Eligibility

Business owners can buy used or new equipment. It all depends on whether or not the equipment was used by a previous owner. Business owners have the option to buy it straight or finance/lease the equipment and still be eligible for this tax deduction.

Small and medium-sized businesses are eligible for Section 179, assuming they make purchases like:

- Machines

- Office equipment and furniture

- Manufacturing equipment

- Laptops, desktop computers, and software

- Personal property for business purposes

Limits of Section 179

All businesses that purchase, finance, or lease equipment with a value of less than $2 million is eligible to use Section 179 tax deductions. But if the equipment cost is over $2 million, it will impact the tax deduction amount.

Purchased Equipment

Qualifying assets for a tax deduction can be a vehicle for business purposes, commercial machinery, property, or software. But to make the tax deduction work for these types of purchases, you have to meet all the added requirements. For instance, any equipment that a business uses to get a Section 179 tax deduction has to be functional before December 31 and should be mentioned on tax forms.

Bonus Depreciation

If there are years without taxable income where you couldn’t make deductions, you can leverage 50% of bonus depreciation. This becomes part of the remaining tax deduction and carries over to the next tax year.

2023 Deduction Limits in Section 179

In comparison to last year, the deduction limit in Section 179 is increased to $1,160,000, which represents a bump of $80,000 in 2023. It means businesses can deduct eligible equipment costs with a valuation of $2.8 million in the same year.

For example, if you buy a piece of equipment from now until December 31 and put it to work during this time for business purposes, then you can make tax deductions using Section 179.

Section 179 Tax Deduction in Numbers

Businesses can write off the entire equipment purchase cost under Section 179. But remember that it is entirely up to business owners to deduct a portion or all of the equipment purchase cost in the same year they purchased the equipment. The smart move is to deduct the costs in the same year as the purchase year rather than make incremental deductions of the equipment cost for 3-5 years.

Besides, there is no reason to distribute the equipment costs across years when you get all the tax deductions in one year. This is a great way to reduce your annual taxable income and lower your overall tax bill in the year you bought your equipment.

Don’t Confuse Section 179 with Standard Depreciation

In a typical depreciation, you would just write off a part of the fixed asset’s cost every year and spread the tax benefits in small portions throughout the equipment’s functional life. So, if the depreciation life of the equipment is 5 years. It would mean you would get tax deductions in five different years rather than all at once.

In Section 179, you can write off the entire cost of equipment in the purchase year. This allows you to get all the tax deductions in the same year rather than get incremental tax deductions over 5 years. Unlike conventional depreciation techniques, Section 179 speeds up tax deductions and makes it easier for businesses to receive them.

What are the Section 179 Requirements?

If you want to benefit from Section 179, you’ll need to meet a few requirements:

- First, the equipment you purchase and use needs to be operational before December 31. The best course of action is to plan ahead and start using the equipment as soon as possible.

- Second, identify elements and avoid situations where equipment is not delivered or available to you on time.

- Third, check equipment eligibility, and that’s because used, and new equipment have different qualifying conditions.

- Whether it’s commercial vehicles, heavy-duty equipment, or office furniture, make sure to check the eligibility beforehand.

- Before you buy a piece of equipment, make sure to reach out to a CPA to see if the equipment you want to finance is eligible for Section 179.

In most cases, you’ll find out that one of the prerequisite requirements to benefit from Section 179 is that your equipment has to be operational for at least 50% of the time. This means you need to use your equipment before the December 31 deadline.

As long as you make your equipment part of your business operations, you can count on using Section 179.

Learn to Calculate Section 179 Potential Tax Savings:

With Section 179, you can get 100% of the equipment cost you buy in 2023. The same rules apply if you’re wondering how to calculate the Section 179 vehicle deduction.

You can use a dedicated calculator to find out specifically how much you can save. Focus on the details, and you should be able to get the right figure that you can deduct through Section 179.

In the calculator, just add the cost of equipment, and it’ll show you the estimated tax savings. It is no wonder many businesses use Section 179 to save thousands of dollars, and all it takes is to buy and use it before December 31.

When it comes to Section 179, the last thing you want to do is overlook potential tax savings. And if you buy equipment worth over $1,160,000, and use it before December 31, then you would also be eligible for Bonus Depreciation.

Leverage Beacon Funding to Get Immediate Equipment Financing

If you don’t want to get caught in the cobweb of old-school equipment financing, Beacon Funding is your best shot. In the digital age, Beacon Funding has simplified the traditional equipment financing process and continues to help out businesses of all sizes and types acquire business financing.

START NOW

With a solid business position and clean credit history, you can count on Beacon Funding to help you get equipment financing in a short period. There is always room to dive into more details and learn more insightful information about tax-saving benefits. So, before you make equipment purchase decisions, reach out to a CPA and talk about your options.