Taxes and deductions can be confusing, so we’ve broken down the IRS Section 179 tax deduction to make it as simple as possible. Section 179 tax deductions can save your business thousands of dollars when you finance new or used equipment. Under the Section 179 tax deduction, small business owners get an upfront tax break when they finance qualifying new or used equipment in the calendar year.

How Section 179 Works

The Section 179 tax deduction allows a business to deduct all or part of the purchase price of certain qualifying equipment that is acquired during the tax year. The incentive created to motivate small businesses to invest in themselves through acquiring equipment.

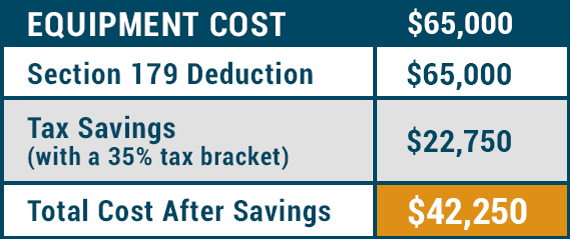

Typically, when your business acquires equipment, tax deductions are realized over the useful life of the equipment. With Section 179, your business is able to write off the entire equipment purchase the year in which it is acquired. Unlike normal depreciation, Section 179 helps to accelerate tax deductions so your business benefits now. Look at this example:

Now let’s get to the nitty-gritty of Section 179 tax benefits. The lease structure (capital vs. operating) will determine the tax treatment. A capital lease may allow your business to write off up to a certain percentage or the total dollar amount of the equipment cost in the first year of the purchase. On the other hand, an operating lease may allow your business to write off 100% of each monthly lease payment and may reduce the amount of income that is taxable by the federal government at the end of the year. Speak to your CPA (Certified Public Accountant) when considering the tax benefits of a lease.

Section 179 Key Takeaways

With Section 179 tax deductions, you can increase your business’ efficiency while putting money back into your pocket; it’s a win-win.

What you need to know:

- Finance qualifying new or used equipment before December 31st, 2020

- If your taxable business income for the year meets or exceeds $1 million, you may qualify for a $1 million deduction with $2.5 million spending cap

- Deduct the entire cost in the first year rather than over time

- Equipment must be used for business more than 50% of the time

- Save on your taxes this year and improve cash flow next year

Bonus Depreciation

Section 179 isn’t the only tax benefit of financing equipment! Bonus depreciation allows you to deduct an additional percentage of the cost on eligible equipment purchases the year you acquire it, rather than depreciating them over a period of years. This year, bonus deprecation remained at 100%, which has doubled since 2017. Section 179 savings can change each year, so to optimize your savings frequently by checking our blog for updates.

Act Now

Now that you know the ins and outs of IRS Section 179 tax deductions, it is time to take advantage of all it has to offer. By combining the Section 179 tax benefits with financing, obtaining new or used equipment can more easily fit into your 2020 budget. To see what your tax savings could be, check out our tax savings calculator. Simply enter the cost of your equipment and get your results. You’ll be surprised by how much you can save!

Remember, equipment must be in use before the end of the year to qualify. Get started on financing now to be sure you get it in time!